By Fola James

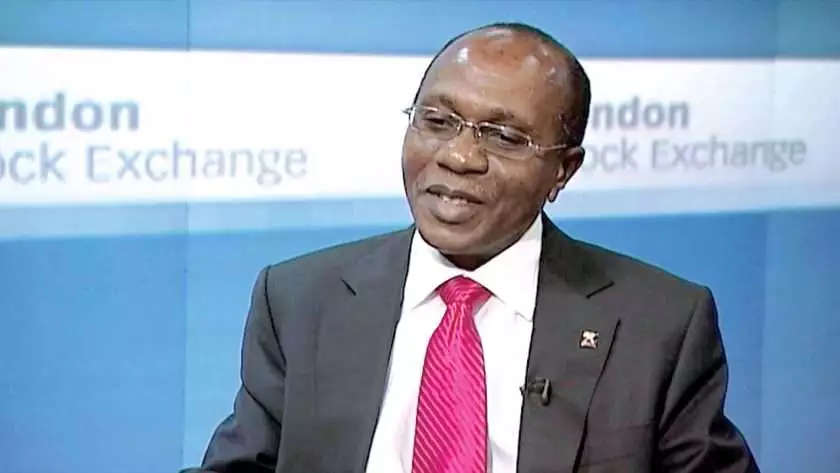

The reduction in lending rates also known as Monetary Policy Rate, MPR to 11. 5 percent from 12.5 per cent is to stabilize the economy after the shocks of COVID 19, the Central Bank of Nigeria, CBN Governor Godwin Emefiele has said.

The apex bank disclosed this on Tuesday after its monthly MPC meeting held in Abuja, the nation’s capital, a move considered by many another way of injecting funds into the circulation.

“The decision will complement the CBN’s decision to support economic recovery and reduce the negative impact of COVID-19 pandemic.

“Also, the liquidity injections are expected to stimulate credit expansion to the critically impacted sectors of the economy output growth and economic recovery,’’ Emefiele said, adding that majority MPC members believe that more capital must be injected into the economy ahead of looming recession.

Analysts insist that the decision is a serious gamble amid steady rise in inflation, that more money in circulation could increase consumption rather than production.

The MPR has been reduced twice this year, the first one being in May when the apex bank adjusted it backward from 14 per cent to 13. 5 per cent.

The belief in the sector is that the CBN is trying to save the economy from going into serious recession by introducing various stimulus packages, including credit expansion targeted at the productive sector.

The CBN had unveiled various stimulus packages, such as concessionary rates, loan restructuring, and targeted loans at critical sectors of the economy such as agriculture, manufacturing and health sectors to reset the economy after the devastating effects of COVID 19.

Emefiele justifies the cut: “After the consideration of the three policy options, members were of the opinion that the option to loose will complement the Bank’s commitment to sustain the trajectory of the economic recovery and reduce the negative impact of COVID-19.

“In addition, the liquidity injections are expected to stimulate credit expansion to the critically impacted sectors of the economy and offer impetus for output growth and economic recovery.”

He said the reduction will encourage the deposit money banks to expand their credit nets

“Accordingly, the implication is that traditional monetary policy instruments are not helpful in addressing the type of inflationary pressure we are currently confronted with.

“What is useful is the kind of supply side measures currently being implemented. MPC also expects that a downward adjustment in MPR may be necessary to further put pressure on our deposit money banks to lower cost of credit in aid of growth.”

He explained that the only way to counter the impacts of the sliding crude oil prices on the economy is to stimulate local production, while also making sure that inflation is put under control.

According to him “The persisting volatility in global oil prices which is likely to continue beyond the end of 2020, as indicated by the deliveries in the oil futures market, signposts the likelihood of a disorderly global recovery

“This will involve targeted investment by the fiscal authorities to resuscitate critical infrastructure to improve the ease of doing business across the country.

“In addition, the MPC believes the fiscal authorities can build on earlier efforts and articulate a clear strategy to attract private sector investment. The Bank will, however, continue to take relevant steps to ensure that the detrimental risk of inflation to the economy is contained.”

Meanwhile, the MPC still retains the cash reserve requirement, CRR at 27.5 per cent and liquidity ratio at 30 per cent.