By Tosin Olatokunbo

Commercial banks in the country are taking serious steps to deal with forex racketeering to prevent sanctions from the Central bank of Nigeria, CBN, the magazine has learnt.

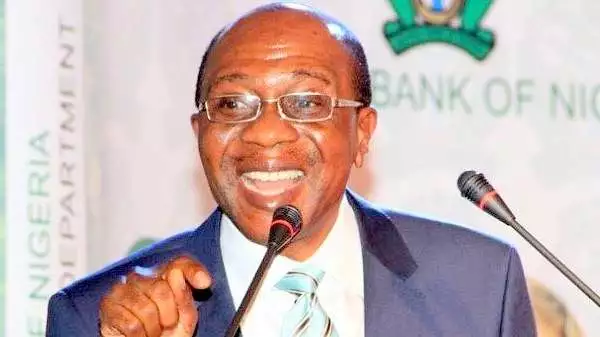

The CBN, had last month, directed commercials bank in the country to sell forex directly to customers after it stopped forex sales to bureau de change. Godwin Emefiele, the apex bank Governor said the measure became necessary after he raised concern “that BDCs have allowed themselves to be used for graft”.

The CBN boss later said the regulator has taken measures to prevent banks from turning forex sales to a racket, warning that “we will deal with them ruthlessly and we will report the international bodies.”

The banks, obviously, do not want to fall under the hammer of the CBN and have therefore, on their own part taken measures to ensure seamless sales of forex to customers, devoid of any fraud.

The first indication to this emerged penultimate week after bank chief executive officers, said at a press briefing after the Bankers’ Committee meeting that they have set up teller points in their respective banks to attend to customers’ forex needs.

The managing director of Access Bank and Chairman of the committee, Herbert Wigwe, who spoke after the meeting, however, warned customers to comply with the rules stipulated by the CBN, as those who do otherwise would be reported to the law enforcement agencies for prosecution.

The magazine learnt that the banks have since followed up by sending messages to their customers to make proper documentation for their forex request as any infraction on their part will attract sanctions.

One of the banks, the United Bank for Africa, UBA, in a statement, urged customers to follow the CBN set rules for their forex request, while submitting documents to obtain Forex for personal, business and travel use.

This includes payment for overseas education, medical and other eligible invisible transactions, the bank said in the statement.

The bank said one of the rules is that forex will only be sold for legitimate travel purpose as applicants are required to provide a valid Nigerian passport and a valid visa to an international destination.

UBA said “Your ticket must be to an international destination outside of West Africa and Cameroon. You are required to provide an international return ticket, with a travel date not more than 14 days from the date of PTA/BTA purchase,” the statement reads. PTA and BTA requests are limited to a maximum of $4,000 and $5,000 per quarter per applicant respectively.

“Customers are required to return purchased PTA/BTA to their bank within two (2) weeks from the date of purchase if not utilized for the intended purpose or if for any reason the scheduled trip is cancelled.”

Application on behalf of a third party is not allowed for forex requests the bank said, warning customers against the use of fake document to avoid being punished.

It warned customers not to “Apply on Behalf of a Third Party. FX will only be sold directly to applicants who shall be Nigerians who are 18 years and above and have a valid Bank Verification Number, BVN.

“False application and use of fake documents to purchase PTA/BTA is strictly prohibited and is a financial crime punishable under the applicable laws in Nigeria.

“Defaulters of this FX policy may face sanctions that include being barred from accessing FX from the official FX market in the future, restrictions on their bank account(s) for such periods as may be determined by CBN as well as possible criminal prosecution,” the Kenneth Uzoka-led bank said.