The federal government has launched a N100 billion credit scheme to boost the economy. The aim, according to the government is to stimulate the economy by ensuring that Nigerians who want to set up businesses have access to funds.

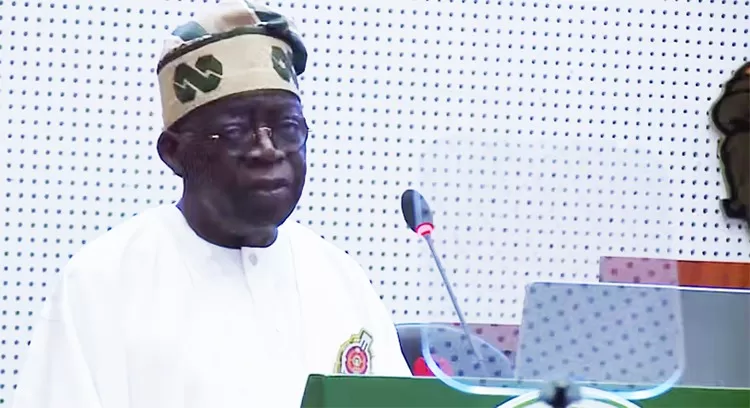

In a statement on Wednesday, Ajuri Ngelale, the Special Adviser to President Bola Ahmed Tinubu on Media and Publicity, said the scheme has already been approved by the president, who has also approved its immediate take of.

The presidential spokesperson said President Tinubu has now fulfilled one of his key campaign promises to ensure that Nigerians are empowered to have access to goods and services through a credit scheme established by the government, stressing that civil servants in the country will benefit from the first phase of the scheme while other Nigerians will benefit later.

Ngelale explained: “Consumer credit serves as the lifeblood of modern economies, enabling citizens to enhance their quality of life by accessing goods and services upfront, paying responsibly over time.

“It facilitates crucial purchases, such as homes, vehicles, education, and healthcare, essential for ongoing stability to pursue their aspirations.

“Through responsible repayment, individuals build credit histories, unlocking more opportunities for a better life.

“Additionally, the increased demand for goods and services will stimulate local industry and job creation.

“The President believes every hardworking Nigerian should have access to social mobility, with consumer credit playing a pivotal role in achieving this vision.

“The Nigerian Consumer Credit Corporation (CREDICORP), which will drive the scheme, will achieve its mandate through the following:

*Strengthening Nigeria’s credit reporting systems, ensuring every economically active citizen has a dependable credit score. This score becomes personal equity they build, facilitating access to consumer credit.

*Offering credit guarantees and wholesale lending to financial institutions dedicated to broadening consumer credit access.

*Promoting responsible consumer credit as a pathway to an improved quality of life, fostering a cultural shift towards growth and financial responsibility.

“In line with the President’s directive to expand consumer credit access to Nigerians, CREDICORP has launched a portal for Nigerians to express interest in receiving consumer credit.

“This initiative, in collaboration with financial institutions and cooperatives nationwide, aims to broaden consumer credit availability.

“Working Nigerians interested in receiving consumer credit can visit www.credicorp.ng to express interest. The deadline is on May 15.”

Discover more from The Source

Subscribe to get the latest posts sent to your email.