By Bayo Bernard

The management of Skye Bank Plc.is currently battling with how to manage allegation that customers’ deposits in the bank are no longer safe, because of a certain syndicate in the Tokunbo Abiru-led bank, involved in fraudulent transfer of money belonging to depositors.

The magazine learned that the issue has sent shock waves among customers of the bank, so much so, that some are already contemplating closing their accounts.

If this happens, financial analysts informed the magazine, it will further compound the numerous problems and scandals that have dogged the bank in the last few years, particularly the controversial resignation of its former Chairman, Tunde Ayeni over mismanagement of depositors funds.

The boardroom battle that ousted Ayeni paved way for the new board under Mohammed Ahmad.

Analysts insist that trust is core to banking. “What this means is that when a customer keeps his money in a bank, he goes back home assured that the money kept in trust will not be tampered with by the custodian, “said Anjorin Kolawole, a banking and financial expert.

But, as it seems, Skye Bank Plc appears to have failed this important test, considering that the bank has now gained notoriety for making money kept in its kitty disappear to the consternation of customers.

Complaints from Skye Bank customers over disappearance of huge sums of money from their accounts have raised serious integrity question for the bank.

“when a bank is no longer safe to keep money, that bank is not qualified” one customer said last week.

While this has been going on for a long time, the management of Skye Bank, the magazine learned has failed to act decisively on the issue, nor tries to rein in the ‘thieving’ employees within its ranks.

Does it mean that the management is not concerned about the effect of such act on the reputation of the bank”? one top banker asked rhetorically last week while reacting to the issue.

Some customers said they had had to swallow the bitter pill of losing their hard earned money without getting any respite from the bank.

But the case of one never-give-up customer has exposed claims by the bank that it has developed potent firewalls against fraudulent practices.

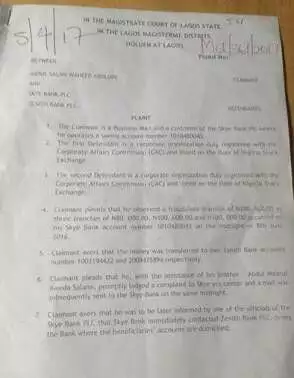

The story of Addul Salam Waheed Abolore, is a touching, pathetic one which no customer is willing to experience from his bank.

His bitter experience with the Abiru-led Skye Bank is instructive, because it portrays the bank as insensitive to customers plight, contrary to claims that its customers are treated like a king.

A struggling business man, Abolore, in spite of the biting economic situation in the country, had managed to open a savings account with the bank after much persuasion from Skye Bank Plc. marketers few years ago.

He opened the said account around 2013, and has been lodging money in the account hoping to use it as capital to expand his business in the future. The savings account number is 1010480043.

Three years after in 2016 something happened that shocked him to his bone marrow.

On June 8, 2016 he was in his home resting after the day’s work when he discovered that N280,000.00( two hundred and eighty thousand naira) has been deducted from his account. According to him, the said amount was fraudulently transferred in three tranches, N80,000.00, N100,000. 00 and N100,000.00 respectively.

The unauthorized transaction took place in the midnight.

The money according to him was transferred to two Zenith Bank accounts number 1003194422 and 2009475894. Angered by the fact that he never authorized the transaction, he set out to recover his money back.

That same night, he contacted the bank notifying it of the fraud so that a prompt action could be taken. He was troubled the whole night because all that occupied his mind was that somebody somewhere was trying to rob him of his hard earned money.

Yet, he persevered with the thought that he has lost, consoling himself that his Bank will intervene to recover his money from the ‘thieves’.

He was dead wrong. For two months the businessman paraded the bank looking for solutions on how to get the money back, but Skye Bank continued to play dilly dally, until he decided to sue the bank.

the magazine was informed by its sources in the sector that a number of customers have suffered under this racketeering going on in the bank. “There are many customers who have lost millions in the bank. While some of them have simply got tired of trying to get their money back, leaving everything to fate, other victims don’t even know what to do. The cost of seeking legal reprieve is simply not affordable for many customers,” Said Amirat Adefowokan, a legal practitioner.

But in his case, Abolore will not give up without a fight.

According to his statement of claims Abolore said“ he did not orchestrate the transaction………….neither did he “ at any time authorize or instruct anybody to transact on his account , ‘rather the fraudulent transfer took place at midnight” while he was sleeping.

Abolore said he went through hell, as he was being pushed back and forth by Skye Bank, even after lodging official complaint with the bank as directed.

Narrating his ordeal the victim said” in spite of his several efforts and visits to different branches of Skye Bank, the transaction was not reversed,” adding that he was “very really surprised at the unexpected quietness” from Skye Bank for the whole time.

The victim further avers that the indifference shown on the issue by the bank suggest” a deliberate attempt to shield the suspected perpetrators of the crime.”

He may be right. This is not the first time the bank will be accused of condoning fraudulent practices.

In 2013, one Yemi-Aris Olaniran, an employee of the bank was charged for defrauding the Federal Government of N78.52 million.

The magazine learned that, indeed, there exist some employees of the bank who specializes in the act of ‘stealing’ money from customers’ account.

Their modus operandi is however not the same.

While some open different accounts in the bank, through which they siphon customers money, insiders told the magazine that another method is to open accounts in other banks, where the syndicate have collaborators.

Some customers with nasty experience who spoke to the magazine said the issue has become an open wound for Skye Bank and as such must be handled seriously by its management, if not the regulatory authority like the Central Bank of Nigeria, CBN must wield the big stick;

But despite several complaints from well-meaning industry players, the bank appears hamstrung or has deliberately refused to take tangible action to deal with the issue decisively.

The implication is that customers could no longer trust the bank to keep their money safe, analysts told the magazine.

Some customers have already abandoned the bank and moved their deposits elsewhere for fear of theft, it was also learned.

The development may not augur well for Skye Bank which is struggling to maintain bottom position among old and new generation banks in the country, according to experts.

The management of the bank must rise up to deal with this menace, according to another financial analyst, Steven Oriowo, who said more danger looms considering the ripple effects of the allegation on current and prospective customers .

Oriowo explained that once other customers learned of the fraud, they are likely to stop doing business with the bank, apart from this, they are most likely to suggest to others to do the same.

‘Take for instance, a customer who have been robbed by the so called syndicate, he will not only tell friends using the bank of his ordeal, he will also notify family members and acquaintances,” the analyst said.

He stated that most customers that learned about the fraud will most likely take action, including “closing their accounts with such bank.”

Lucas Idigbe, a psychologist told the magazine that there’s the tendency for people to react the same way when money is involved. He described it as a chain effect.

According to him, the reaction that somebody is trying to rob others of their hard earned money can be mutual, in the sense that “the other person who’s yet to be robbed will begin to think that ‘what happened to him’ could also happen to me.”

“The problem can even get worse for the bank under this harsh economic situation facing the country when people are finding it difficult to feed their families.

For somebody to save money at this time, he must have made huge sacrifice and faced a lot of hardship. Now imagine the feeling that the money could be stolen from the bank where you keep it, the immediate reaction will be to do something quickly,” he said.

Top financial analysts told the magazine that the bank has struggled with many controversies in the last few years and that the current one could compound its problems, particularly the bank’s perception index among other variables.

The bank failed to respond to the allegation when it was contacted by the magazine, Rasheed Bolarinwa, spokesman of the bank failed to respond to e-mail sent to him despite his promise to do so.

Discover more from The Source

Subscribe to get the latest posts sent to your email.