By Tosin Olatokunbo

Tokunbo Abiru, the managing director of Polaris Bank Limited is leaving the bank a fulfilled man. He has served meritoriously, first as the chief executive officer of defunct Skye Bank Plc and later Polaris Bank, following the CBN intervention that saved the bank from bankruptcy in 2018.

Last week, Abiru, believed to be the preferred candidate of APC National Leader, Asiwaju Bola Ahmed Tinubu as replacement for Adebayo Osinowo, who died in June, to represent Lagos East in the Nigerian Senate, informed his staff that he was leaving the bank to pursue other ambitions.

The outgoing Polaris Bank CEO who served as Commissioner of Finance in the administration of Governor Babatunde Raji Fashola, has reasons to be proud. Through sheer expertise the seasoned finance administrator has, within two years lifted the once problematic bank from near collapse to what has now become envy to its peers, so much so that the lender was able to return N27 billion profit After Tax, PAT in the 2019 financial year.

Reeling out his achievements to staff recently the elated Abiru said “It gives me great pleasure to say that, with the support of the Board, Executive Management and all of you, we have delivered on the mandate given to us by the Central Bank of Nigeria upon assumption of office in 2016.

“We have reversed almost all regulatory ratios for good and currently rank amongst the very best in the industry. There can be no better testament to the much-improved state of the Bank than the full year 2019 results in which the Bank posted Profit After Tax, PAT of N27billion.

“To buttress the fact that this is sustainable, the Bank’s first half 2020 result showed a PAT of over N18billion, despite the tremendous headwinds brought on by the COVID-19 pandemic.”

From all indications, the bank’s staff are happy that things have turned around for better.

The shareholders too are elated and not left out, the apex Regulator, CBN, that Abiru delivered on the mandate of revamping the bank.

But can the same be said of some customers who had lost their hard earned money to the dubious acts of some employees of the bank?

That the bank has not been able to resolve the issue of fraudulent transfers of money from customers’ accounts is a big worry to many stakeholders.

The fact that customers who suffered from this fraud have not received their money back has continued to marvel close watchers of the bank, two years after it claimed to have rebranded.

Another thing that should worry the managers of the bank, is the notion that Polaris Bank is among commercial banks in the country with the highest employee fraud.

“In spite of Abiru’s achievements, the outgoing managing director has failed to rein in the syndicate involved in fraudulent withdrawal of money belonging to customers which has remained a snag on the integrity of Polaris Bank,” a financial analyst said.

According to him “a bank cannot be claiming to do well when customers harbor the feelings that money kept in its care is not safe. Trust is a universal banking principle that forms parts of the integrity of any commercial bank. When you lost it, nothing is left.”

He explained that integrity is when an organization, trying to prove to customers that it has taken a new leaf from its inglorious past, redeems or restitute that dirty past.

Polaris Bank have shelved Skye Bank as its old name, but it still carries the negative weight of the old bank which it has obviously failed to resolved: the ‘syndicate’ employees who withdraw money from customers accounts without their consent are still very much working with the bank, while the Abiru-led bank has failed to return money fraudulently withdrawn from customers’ account, analysts say.

The case of one customer, Abdul Salam Waheed Abolore has continued to hunt Polaris Bank and put a lie to claim that it has shelved its old garment of fraud and that all its customers are happy, analysts insist.

Few years ago, Abolore struggled to open an account with the bank despite the harsh economic condition, which hardly left anything for savings.

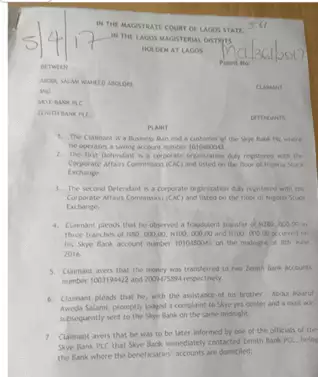

According to him, he agreed to open the account in 2013 after persuasion from marketers from the bank, and planned to use whatever he saved to expand his business in the future. Abolore gave the savings account no as 1010480043.

What happened three years after he opened the account has not stopped to confound him till today.

He was in his house resting on June 8, 2016 around 12 pm when he received an alert that N280,000 has been withdrawn from his account. The amount, he said was fraudulently transferred in three stages: N80,000, N100,000 and N100,000 respectively.

The money, he explained was transferred to two Zenith Bank accounts number 1003194422 and 2009475894. Since he did not authorized the transaction, he started worrying that something sinister must have happened.

All through the night he could not sleep, waiting for the day to break so that he could go to his branch to lodge an official complaint.

At least, he still trusted the bank enough to believe that the problem will be resolve as soon as they listen to him.

But that was not what happened when he got to his branch the following day to lodge a complaint that money has been withdrawn from his account the night before without his consent.

He was shocked that the staff who attended to him did not show much empathy, thus confirming his earlier fear that somebody is trying to rob him of his hard earned money.

The staff on the counter, he said, started asking him questions such as, whether he disclosed his account details to somebody, or maybe he lost his ATM card. None of the above happened he politely told them as they drilled life out of him.

Since then he has been trying to recover his money.

For two months after the incident, angry Abolore kept on going to the bank so that they can solve his problem. At a point, he finally got tired of begging the bank to do the right thing by crediting his account with the same amount illegally withdrawn from his account.

Many customers informed the magazine that they have also lost huge sums in a similar situation but that effort to get refund has always been met with resistance.

Like Abolore, some victims had tried to get the bank do the right thing but simply developed cold feet along the line, while others, bold enough to approach the court for remedy are currently stuck there, not knowing when they will get their money back.

“Some customers have got tired of going to the bank to complain, leaving the bank to God. Some who could have approached the court for reprieve cannot afford the legal fee,” said Gbemi Fatoye, legal practitioner handling one of the cases.

In the case of Abolore, he’s not ready to give up his money simply because of the wall of resistance mounted by the bank.

According to his statement of claims Abolore said “he did not orchestrate the transaction………. Neither did he “at any time authorize or instruct anybody to transact on his account, “rather the fraudulent transfer took place at midnight,” while he was sleeping after a hectic day’s work.

He explained that he has gone through hell while trying to recover his stolen money.

But “in spite of his several efforts… the transaction has not been reversed,” he said in the court papers, adding that he was “very really surprised at the unexpected quietness,” from the Abiru-led management.

He accused the bank of “a deliberate attempt to shield the suspected perpetrators of the crime,” which many believe are still in the payroll of the bank.

He may be right. The bank has been mentioned in several fraud cases in the past.

In 2013, one Yemi-Aris Olaniran, a staff of the bank was charged for defrauding the federal government of N78.52 million.

Also in February this year, the Economic and Financial Crimes Commission, EFCC charged Babatunde Keshinro, a staff of the bank for theft, forgery and fraudulent withdrawal of N12.6 million belonging to a customer.

Many other cases abound.

The fact that the employees that specialize in stealing money from customers’ accounts have not been exposed or sacked, even after the bank has rebranded, close watchers insist, has put a big question mark on the determination of its management to rid its ranks of thieves in the garb of employees.

Chris Adesegun, a psychologist said” when potential or existing customers read these ugly stories, they are bound to take informed decision, because nobody wants to learn from his own bitter experience.”

He said the feeling that “I may likely lose my hard earned money when I put it in a certain bank is enough” for any customer not to want to have anything to do with that particular bank, particularly “at this time when things are very tight.”

He said the bank cannot afford to live with negative stories that it’s among commercial banks in the country with the highest employee fraud index, now that things seem to be looking up and the “feelings that Polaris Bank has escaped collapse, looms large in the sector”.

When the magazine contacted the bank’s spokesman, Rasheed Bolarinwa, for his response to the issue, he did not answer his calls neither responded to text messages sent to his telephone line.

Discover more from The Source

Subscribe to get the latest posts sent to your email.