Nothing has shocked me in my entire life in public service as the revelation from Nigeria’s First Quarter 2020 financial reports in the Medium Term Expenditure Framework and Fiscal Strategy from the Federal Ministry of Finance, Budget, and National Planning, which shows, alarmingly, that whereas Nigeria spent a total sum of ₦943.12 billion in debt servicing, the Federal Government’s retained revenue for the same period was only ₦950.56 billion. This means that Nigeria’s debt to revenue ratio is now 99%.

No one should be deceived. This is a crisis! Debt servicing does not equate to debt repayment. The reality is that Nigeria is paying only the minimum payment to cover our interest charges. The principal remains untouched and is possibly growing.

We are at a precipice. If our revenue figures do not go up, and go up quickly, Nigeria risks a situation where our revenue cannot even sustain our debt servicing obligations. Meaning that we may become insolvent, and our creditors may foreclose on us, as has occurred in Sri Lanka and the Maldives.

In my opinion editorial of December 17 2019, titled ‘Endless Borrowing Will Lead Nigeria to Endless Sorrowing’, I had cause to counsel the Federal Government to desist from indiscriminate lending, and offered suggestions on ways to both increase revenue and reduce expenditure. However, my counsel fell on deaf ears. And now we have come to this.

Again, on May 15, 2020, I counselled that the Federal Government ought to reduce Nigeria’s budget by at least 25%, to reflect the economic realities of the times that we live in. Again, my entreaties were brushed aside.

As part of an administration that paid off Nigeria’s entire foreign debt, I am concerned by the alarming and avoidable unprecedented increase in our debt to GDP ratio and debt to revenue ratio. The alarm I sounded last year is now sounding louder.

Not only have we squandered our opportunities, we have also squandered the opportunities of our future generations by bequeathing them a debt that they neither incurred nor enjoyed.

As a matter of utmost urgency and importance, I call on the Federal Government to take immediate steps to drastically reduce its expenditure, especially on wasteful projects, such as maintenance of the Presidential Air Fleet, and unnecessary renovations of buildings that could serve as is, limousine fleet for top government officials, overseas travels and treatments, and the ₦4.6billion Presidential villa maintenance budget, etc.

We cannot be on the verge of economic ruin, while still maintaining a Presidential Air Fleet that has more planes than the Presidential fleets of those from whom we take these loans. Nigeria must sell those planes and channel the revenue to other vital areas of need while taking additional steps to reduce the cost of running our government.

The Federal Government cannot continue to justify these unsustainable numbers by pointing at Nigeria’s debt to GDP ratio. That is only half the picture. Our debt to revenue ratio paints a much more realistic portrait of our financial situation, especially as our revenues are majorly tied to a mono-product, oil and gas, which are very vulnerable to global shocks.

Again, I warn that Nigeria is facing a crisis, and we cannot continue to keep up appearances by taking out more loans to prop up our economy. That will amount not just to robbing Peter to pay Paul, but to robbing our children to pay for our greed!

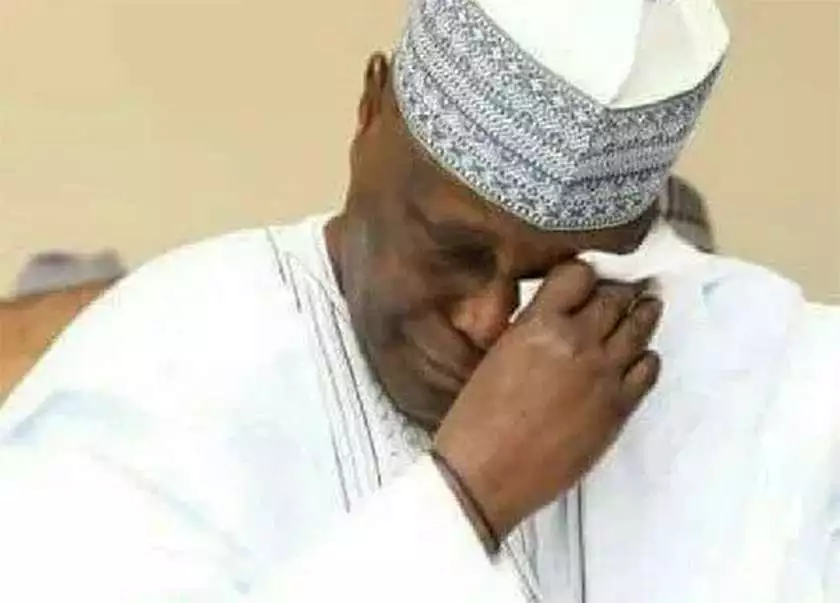

Atiku Abubakar, GCON, was former Vice President, and Presidential Candidate of the PDP in the 2019 Presidential Election

Discover more from The Source

Subscribe to get the latest posts sent to your email.