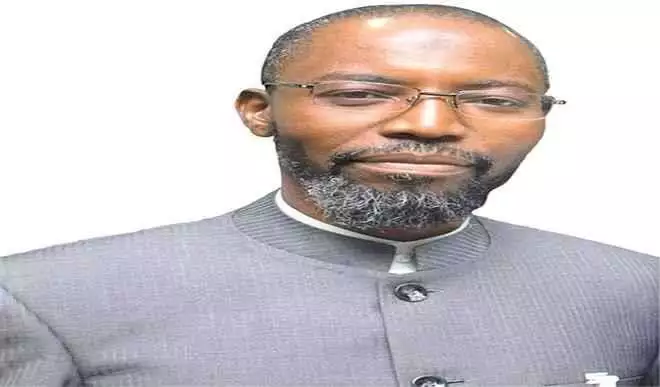

The managing Director of Jaiz Bank Plc Hassan Usman appears to have moved past the rumoured board room crisis in the bank and itching towards making it the leading non-interest bank in Sub-Saharan Africa, after the bank posted a whopping N2.13 billion profit before tax, PBT in the third quarter of the year.

Nigeria’s financial sector has been worst hit by the global pandemic, in spite of this, analysts insist that Jaiz Bank’s fundamental remains strong considering that it recorded tremendous increase in many other key areas apart from the PBT which rose by over 44 per cent compared with the same period in 2019 according to the report submitted to the Nigerian Stock Exchange, NSE.

According to the report, profits after stood at N1.85 billion as at the end of September 30, 2020, compared to N1.25 billion earned at the end of September, 2019, which shows an increase of 47 per cent.

According to a statement from the bank, breakdown of the results shows that the total assets of the Usman-led bank as at September 30, 2020 stood at N210 billion year on year, YoY 2019 which was N167 billion, an increase of 25.67 per cent.

Endorsed by the Central Bank of Nigeria, CBN, the report indicate that the bank earned N13.65 billion Gross income within the same period compared to N9.37 billion in the corresponding year 2019.

The bank’s earnings per share also increased by 48 per cent from 4.25 kobo to 6.28 kobo year on year, YoY, the statement said.

Meanwhile, the managing director of the bank has assured that steady focus on elements that contributed to improved performance will be sustained for the rest of the year.

Discover more from The Source

Subscribe to get the latest posts sent to your email.