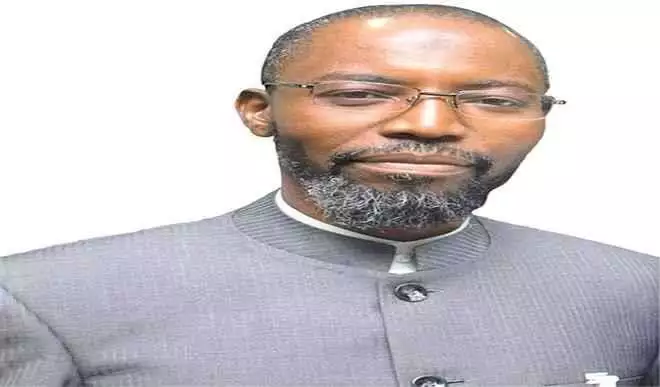

The managing Director of Jaiz Bank, Hassan Usman says the Islamic bank will maintain profitable results for the rest of the year 2021 financial year.

The bank’s chief executive disclosed this after declaring over 70 per cent growth in Profit After Tax, PAT, from N1.17 billion declared in June 2020 to N1.99 billion at the end of June 2021. This amounts to N820 million in 12 months.

Usman said the bank has leveraged on its positive outing in 2020 where it recorded a profit before tax of N3.07 billion, despite the COVID 19 pandemic headwind. The bank had earlier posted N5.99 billion for the first quarter of the year.

Speaking on the results Usman said his bank “is committed to maintaining the remarkable earnings streak for the rest of the year by leveraging on technology and the expansion of its retail banking portfolio.”

According to the financial results released by the Nigerian Exchange, NGX the bank’s profit after tax rose by 70.1 per cent growth to N1.9bn in the first half of 2021 from N1.17bn in the same period of 2020.

A statement by the bank said it grew profit by over 70 per cent within the last six months of the year.

The statement titled, ‘Jaiz Bank grows half-year profit by over 70 per cent,” said “Financial results of Jaiz Bank Plc for the second quarter which ended on 31st June 2021 was released to the Nigerian Stock Exchange, showing a 70.6 per cent growth in profit after tax, from N1.17bn declared in June 2020 to N1.99bn at the end of June 2021.”

It further disclosed that the bank’s total income for the period under review grew by 42.1 per cent from N6.23bn as at end of June 2020 to N8.86bn at the end of June 2021.

The bank’s earnings per share for the period under review jumped from 3.89 kobo in the first quarter of 2020 to 6.78 kobo at the end first quarter of 2021, indicating a 70.3 per cent increase.

The statement said the positive result is an assurance to customers and shareholders that the bank remained the leading non-interest bank in the country.

Discover more from The Source

Subscribe to get the latest posts sent to your email.