The Managing Director/ chief executive officer CEO of Fidelity Bank Plc Nneka Onyeali-Ikpe has assured exporters that they will be provided with necessary expertise and financial support that will enable them export to the United States of America, USA.

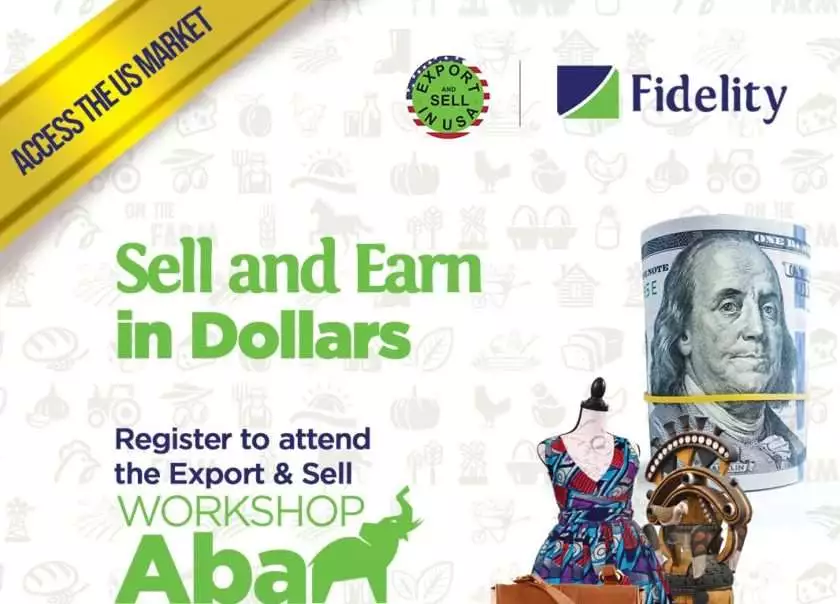

The lender’s chief executive disclosed this as the leading financial institution prepares to host a workshop for businesses looking to scale and expand their reach into new international markets.

“For more than three decades, we have helped customers scale up their businesses through the right mix of financial and non-financial solutions including access to markets initiatives like our Export and Sell workshop scheduled for Aba.

“With the workshop, we aim to guide customers and prospects in developing the competence necessary for selling to the US market,” Onyeali-Ikpe said.

The training, which is scheduled for Wednesday, 6 April 2022 in Aba, Abia State, is being put together in collaboration with Export & Sell Limited -a trade enabling platform that facilitates the listing of Nigerian businesses on Amazon as well as access to other US off-take markets.

Similarly, Nduka Udeh, Managing Director/CEO of Export and Sell LLC, expressed his excitement to collaborate with Fidelity Bank on the project and commended the financial institution for the initiative.

Giving a summary of what participants are to expect, Udeh explained, “The training offers a practical approach to exporting and will show businesses how to prepare the correct documentation required to export to the United States of America (USA), how to find buyers, how to list products and sell on Amazon, how to export food products and the various licenses needed as well as other aspects of exporting”.

He added that assisting businesses to export would have an enormous ripple effect across the economy by increasing the volume of export earnings.

According to the bank, the seminar is designed for businesses in the following sectors: Food and Beverage; Fashion and Textile; Leather and Foot ware; Furniture and Woodwork; Art and Craft, Beauty and Cosmetic Industries, Pet Products, Building Materials; Light Equipment; as well as Chemical and Petrochemical industries.

After the training, Export & Sell would help businesses to revamp their products packaging, and sales literature, making sure they meet the specifications to sell on Amazon and other US outlets.

The workshop comes to join a long list of dedicated initiatives put in place by the bank to help local businesses play on the global scale and attract foreign exchange earnings. For instance, it’s Export Management Programme (EMP), which was launched in 2016 and is hosted in partnership with the Lagos Business School and the Nigerian Export Promotion Council (NEPC), equips participants with requisite knowledge for driving non-oil exports.

The bank also launched the CBN RT200 FX Policy Sensitisation series in February 2022 to highlight opportunities for importers looking to pivot to exporting with the aid of the policy.

Fidelity Bank is a full-fledged commercial bank operating in Nigeria with about six million customers who are serviced across its 250 business offices and digital banking channels.

The bank was recently recognized as the Best SME Bank Nigeria 2022 by the Global Banking & Finance Awards and in 2021, the bank won the awards of the “Fastest Growing Bank” and “MSME & Entrepreneurship Financing Bank of the Year” at the 2021 BusinessDay Banks and Other Financial Institutions (BAFI) Awards.

Discover more from The Source

Subscribe to get the latest posts sent to your email.