The federal government has shut the businesses of some illegal money lender in the country. The Source magazine had earlier reported that most of the illegal online financial institutions are mostly owned by foreigners, particularly the Chinese.

Last month, the Director General of the Federal Competition Consumer Protection Commission, FCCPC Babatunde Irukera had warned that the agency may be forced to move against the businesses of the illegal money lender following complaints of harassment by many Nigerians.

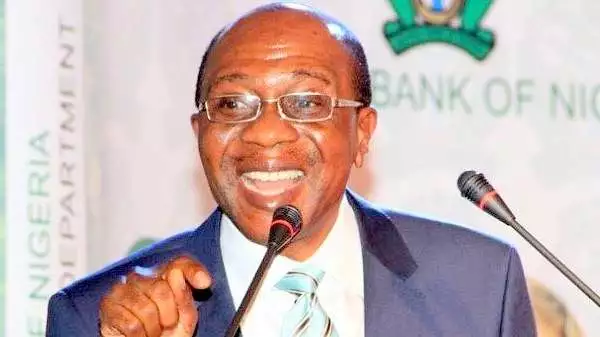

The Governor of the Central Bank of Nigeria, CBN Godwin Emefiele had also lamented that the money lenders have become problems for many Nigerians who are unsuspecting of their dubious activities.

On Friday, the FCCPC alongside the Independent Corrupt Practices and other Related Offences Commission, ICPC National Information Technology Development Agency, NITDA and the Nigerian Police Force, NPF raided some illegal financial institutions operating in Lagos.

The money lenders offices raided by security agents include GoCash, Okash, EasyCredit, Kashkash, Speedy Choice, Easy Moni, among others.

Irukera, said the agency had to wade in after series of complaints from customers. He explained that the money lenders become popular during the covid 19 lock down two years ago, but have since a problem.

According to him, “some time ago, when the country was on lockdown in 2020 due to the pandemic, we started seeing the rise in money lenders.

“Because there was lockdown due to the pandemic, people needed small easy loan which is understandable. But over a period of time, people started complaining about the malpractices of the lenders, so we started tracking it”

“Towards the end of last year, we gathered quite a lot of information. We started working with some other key agencies and the FCCPC led the meeting where we all agreed there would be a joint effort to look into these businesses”.

He explained that one of the reasons why the agency decided to act was the complaints that the lenders charge exorbitant interest from customers who find it to pay back the loan.

When this happened, the agency said such customers are subjected to unwarranted embarrassment forbidden by law.

“The key two things that were subject of concern were what seems to be the naming and shaming violation of people’s privacy with respect to how these lenders recover their loans.

“Secondly, the interest rate seems to be a violation of the ethics on how lending is done. So, those were the two things that we set out to look for,” Irukera said.

He stated further that “so, we started an investigation trying to determine the location of these firms. That has been a very difficult thing. We did that for several months and some of them have moved from one place to the another and we have been visiting these places for months”.

He said the agency had to intervene to save Nigerians.

He said, “we found out that most of these companies operate from the same place. We also found out that many of them are actually operated by the same person. They are not Nigerian companies, they don’t have an address in Nigeria and they are not registered in Nigeria with the Corporate Affairs Commission and they do not have any license to do their business”

Having found out that many illegal money lenders operate online, the agency has now written to global applications operators with the possibility of closing some online financial applications operating in the country.

Irukera said “in addition to what you are seeing here today, the FCCPC has also issued multiple orders today. Two of them are going to vendors: Apple and Google stores where some of these apps are available.

“We have asked them to shut these companies’ apps down so that people will not be victimised anymore. Secondly, some of them (the orders) have gone to the bank, asking them to freeze the accounts used by these people.”

The FCCPC boss however stated that not all money lenders are operating illegally.

Discover more from The Source

Subscribe to get the latest posts sent to your email.