The Federal Government plans to up the National debt to beyond the N50 trillion mark by 2023, according to the National Development plan 2021-2025.

There has already been reservations among Nigerians who believe that Government is enslaving future generation to the creditors who, like Chinese Government, do not have a benign history of debt recovery.

Government borrowing plan is to raise money through domestic bonds and concessional external loans where domestic debt will increase by N28.75tn and external debt by N21.47tn.

Government is already indebted to the tune of N38 trillion as at the end of the third quarter of 2021, according to the Debt Management office.

By extrapolation, a fresh debt of N12 trillion is expected in two years if the projection is carried through.

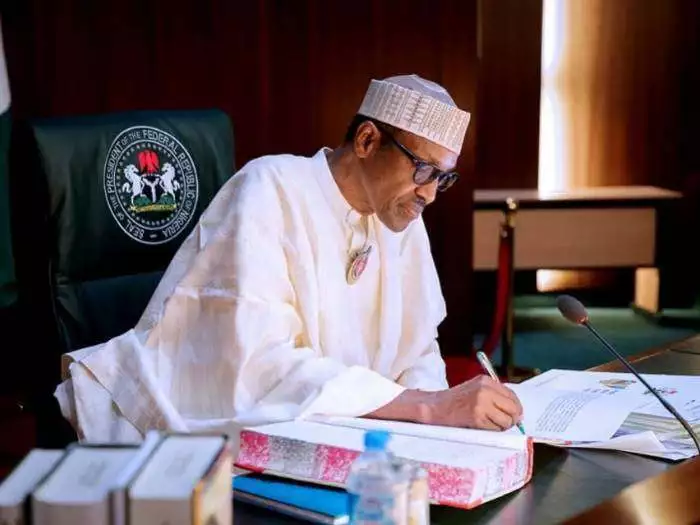

President Muhammadu Buhari intends to borrow N39.59tn for 2021, N46.63tn for 2022, N50.22tn for 2023, N50.53tn for 2024, and N45.96tn by 2025.

To finance this projection, which brings the plan to N348.1tn, Government needs to finance it to the tune of 45 per cent each for both foreign and domestic borrowing.

“The plan will require an investment of about N348.1tn to achieve the plan objectives within the period of 2021-2025. It is estimated that the government capital expenditure during the period will be N49.7tn (14 per cent) while the balance of N298.3tn (86 per cent) will be incurred by the Private Sector. Of the 14 per cent, government contribution, FGN capital expenditure will be N29.6tn (9 per cent) while the sub-national governments’ capita” the plan read in part.

“The borrowing framework in the plan is 45 per cent each for both foreign and domestic borrowing while the other financing sources account for 10 per cent. Domestic bonds and concessional external loan financing, amongst others, will account for the borrowing strategies for the plan. Thus, the government will improve on current debt management strategies to ensure sustainability.”

Discover more from The Source

Subscribe to get the latest posts sent to your email.