Ecobank Nigeria Back2School Loans scheme will assist parents who are already agitated about how to pay school fees as students prepare to go back to school soon, the Pan African bank has said.

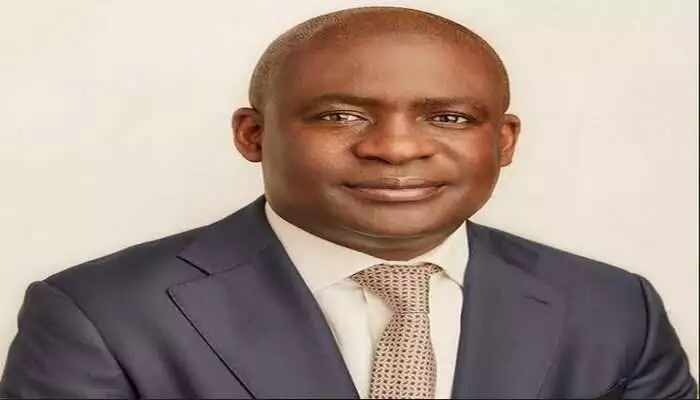

The Jubril Mobolaji Lawal-led commercial bank said it made the loan scheme available to customers due to the value it placed on education.

Unveiling the scheme in Lagos, the Head, Consumer Banking, Ecobank Nigeria, Korede Demola-Adeniyi said the loan offerings also come with other Back2 School gifts for customers who take advantage of it, as soon as they receive school fees payments to their Domiciliary accounts.

The bank said the scheme has given parents the freedom to care of other financial burdens without getting worried about school fees, adding that the bank has a trajectory of taking care of various customers’ needs.

According to Demola-Adeniyi, the scheme is available to new and existing customers, noting that this is the perfect time to open an Ecobank account or reactivate dormant ones, in both local currency and foreign currency, to enjoy all the benefits of the Back2School Scheme.

She said, “we are aware that our customers are diverse with different needs and belong to different segments of the society hence we are always coming up with initiatives like this to cater to our various target markets” . In the same vein, the bank is offering competitive rates on FCY inflows whether as fixed deposits or as cash collateral for loans.

Speaking on the dynamics of the scheme, Daberechi Effiong, Head, Consumer Products, stated that loan offerings are available to all categories of customers in paid and self-employment.

“Customers can either opt for the Employee Credit or Cash backed Back2School scheme based on their cashflow,’ she said.

The cash backed scheme gives customers access to competitive interest rates on their funds while accessing the Back2School loan. For the Employee Loan, customers can access up to N20 million for the purpose of school fees payment. The low-cost loan also comes with flexible tenors, the bank said

Effiong listed the benefits of the Back2School scheme to include, convenient repayment with flexible tenors to match customers’ cashflow, the competitive interest rate on loans, the competitive interest rate on deposits for cash-backed loans and foreign currency inflow, exciting Back2School gifts, additional N5 per dollar on remittance inflows received and easy access to other loan products including the Buy Now Pay Later scheme with SPAR.

Discover more from The Source

Subscribe to get the latest posts sent to your email.