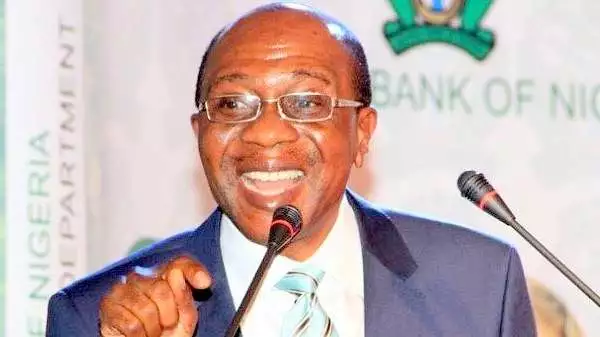

A group supporting President Muhammadu Buhari, Nigeria First Movement, NFM has blamed the Central Bank Governor, Godwin Emefiele for the nation’s economic woes, noting that the recent introduction of the digital currency e-Naria is the “final nail in the country’s already doomed economy.”

The pro-Buhari group which said the economy has been wobbling since the re-appointment of Emefiele by the president, vowed to mobilise over 200 other pro-Buhari groups against the apex bank governor if he failed to resign.

The group Coordinator, Augustine Richard in a statement said many Nigerians were disappointed with the tedious registration processes as part of the requirements for the e-naira.

Richard said Emefiele enjoyed the privilege of being the only CBN Governor to be re-appointed, in spite of this, the group pointed out, Emefiele has failed to use his position to turn the economy around, adding that the launch of the e-naira has prove this point.

NFM said, “the introduction and subsequent launch of the digital currency, eNaira, is perceived as the final nail in the country’s already doomed economy.

“We are ready to champion the call for Emefiele’s removal by staging a one-week protest that could potentially cripple economic activities in Abuja. We’re also ready to mobilise over 200 other pro-Buhari groups across the globe in the ‘mother of all protests’ that would hold simultaneously in Abuja, Lagos and London against the nation’s poor economic posture.

“Emiefele played a pivotal role in the collapse of the economy since his appointment as the CBN chief and before his arrival, the economy was said to be one of the fastest growing in the world. Shortly after his reappointment in 2019, Emefiele announced a five-year plan that targets double-digit growth in one of Africa’s largest economies.

“His approach to policy implementation, however, has left many in doubt, raising questions on how his key policy move, especially in the context of management of the exchange rate, benefits the economy, and the naira he sought to protect.”

The group further accused the CBN of rolling out various economic programmes which it said have no direct effects on the lives of Nigerians.

Richard further said in the statement that “on July 24, 2020, the CBN launched a series of non-intrant loan schemes under the AGSMEIS, MSMEDF, AADF and other loan schemes. The program attracted a lot of Nigerians, with millions of them seeking to join the program through all due process.

“For more than a year now, nothing has been done. The CBN under Emefile has shirked its primary responsibility of ensuring price stability and has embraced a more developmental role, in the hopes of naira stability.

“As confirmed by the Chairman of the House of Representatives Committee on Finance, Rt. Hon. James Faleke, the CBN has failed to submit its Audited Account to the Office of the Auditor General (OAGF) for review, from 2010 to date.

“According to Kalu Ajah, chief executive officer at AfriSwiss Capital Assets Management Limited in Abuja, the CBN has pursued a strong naira policy and had sought to dampen imports. Well, imports have not declined and the naira is far from strong. One wonders if the import restrictions on items and capital controls were necessary or if the CBN should have devalued the naira earlier. I will say Nigeria did not benefit from the capital controls regime.

“The regulatory bank’s aggressive lending policy has been called into question as well, causing some concerns over the bank chief’s stewardship of the banking sector. The CBN is forcing banks to lend, and penalising non-lenders. These are shareholders’ funds being deployed via fiat.

“In October last year, the Central Bank fined 12 banks, including Citibank, First Bank of Nigeria, Guaranty Trust Bank, and Standard Chartered Bank N499 billion for failing to meet lending targets. It is another move that attracted criticism across the board,” he said.

Discover more from The Source

Subscribe to get the latest posts sent to your email.