An economic think tank, Centre for the Promotion of Private Enterprise, CPPE has urged the Central Bank of Nigeria, CBN to reduce the Cash Reserve Requirement, CRR imposed on Nigerian bank because of its negative impacts on the banks.

The body disclosed this in its economic and business environment review for 2021 and agenda for 2022, also urging the CBN to review its forex policy.

For instance, the centre said the 27.5 per cent statutory cash requirement has limited the ability of commercial banks in the country to lend to the public for productive purposes.

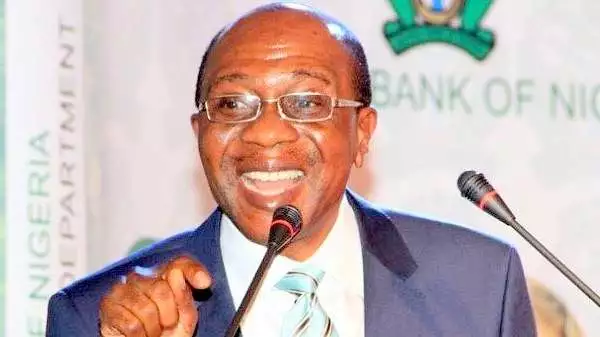

The Godwin Emefiele-led CBN has maintained the ratio, despite complaints by banks in the country that the policy is having a serious toll on their ability to expand credit to their customers.

CPPE said the CRR must be reviewed in favour of the banks, adding that some banks in the country have more than 50 per cent of depositors’ funds deposited with the apex bank.

It said CBN’s efforts must be geared towards deepening investment in the country rather than stiffening it.

According to the centre,“financial intermediation is supposed to be the major function and essence of the banking system. The high CRR has made it difficult for the banks to play their primary role of financial intermediation.

“Their profitability is also adversely impacted because of limited room for credit creation activities. “Indeed, the ways and means finances of the apex bank pose greater liquidity risk to the economy than bank deposits. We therefore seek a reduction in CRR so that the banks can be better placed to play their primary role of financial intermediation in the economy.”

On the CBN forex policy, the body said, “our proposition is that we should adopt a flexible exchange rate policy regime. We would like to clarify that this is not a devaluation proposition.

“Rather, it is a pricing mechanism that reflects the demand and supply fundamentals in the foreign exchange market. It is a model that is sustainable, predictable and transparent. It is a policy regime that would reduce uncertainty and inspire the confidence of investors.

“It is a policy framework that would minimise discretion and arbitrage in the foreign exchange allocation mechanism. A flexible exchange rate regime is a policy choice adopted to cope with changing demand and supply conditions in the forex market.”

At the last Monetary Policy Meeting, MPC for the year, held in November the members agreed to maintain all monetary parameters including the CRR. To do otherwise, Emefiele said at the end of the meeting, would mean to pull the country back from the path of recovery.

MPC said “On the other hand, whereas loosening will lower policy rates, ease liquidity pressures, and stimulate additional credit creation which will boost output growth, MPC also thinks that loosening will further widen the negative real interest rate gap and compound the price distortions in the money markets which could fuel inflationary pressures.

“As for whether to hold its existing stance, MPC believes that the existing monetary policy stance has supported the growth recovery and should be allowed to continue for a little longer for consolidation to achieve the MPC mandate of price stability that is conducive for sustainable growth. The Committee also feels that a hold stance will enable it to carefully appraise the implications of the unfolding global development around policy tapering and normalisation by advanced economies.”

Discover more from The Source

Subscribe to get the latest posts sent to your email.