The Central Bank of Nigeria, CBN, will no longer give loans to the federal government in term of ways and means.

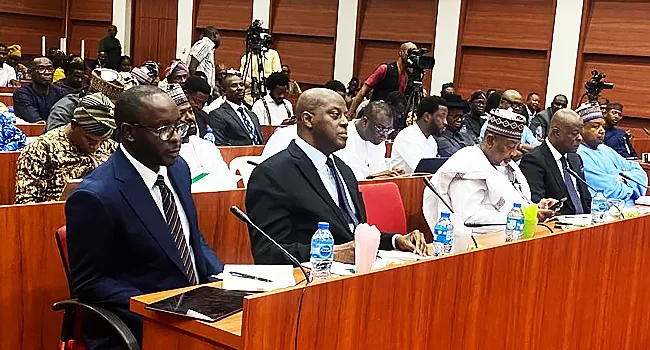

CBN Governor made this known on Friday after he met alongside other members of the Economic Team with the Senate Committees on Finance, Appropriations, Banking, Insurance, and Other Financial Institutions.

The Senate had summoned the Economic Team led by Wale Edun, the Minister of Finance and Coordinator of the Economy to respond to the current hardship in the country and what is being done to ameliorate the situation.

Recall that the apex bank had blamed the excess cash in circulation for the current inflation ravaging the country.

The cost of basic commodities like food and other household items has hit the rooftop in the last few weeks, as Nigerians slam the authorities for not doing enough to arrest the situation.

Answering questions from the committee yesterday, Cardoso blamed the current inflation on the excess Naira in circulation fueled by the previous administration over-borrowing from the CBN through the W&M window.

The CBN Act provides that five percent of the yearly Budget be borrowed from the apex bank to plug deficit, Buhari, according to checks abused the window by borrowing as much as N24 trillion within eight years of his administration.

Under him, according to figures provided by the CBN W&M rose to an unprecedented level of 2900 per cent to N23.8 trillion.

When the former president came to power in 2015 CBN loans to the federal government stood below N800 billion cumulatively.

According to Cardoso, the apex bank has now introduced strict measures to curb such abuse of power by the federal government in line with its enabling Act.

Cardoso said: “On our side at the CBN, we have responded with significant monetary policy tightening to reign in inflationary pressure.

“Empirical analysis has established that money supply is one of the factors fueling the current inflationary pressure. For instance, an analysis of the trend of the money supply spanning over nine months shows that M3 increased from N52.01tn in January 2023 to N68.25tn in November 2023 representing N16.24tn or 31.22 percent increase over the period.

“Increase in Net Foreign Asset following the harmonisation of exchange rates and the N3.22tn ways and means advances were the major factors driving the increase in the money supply.”

“I am pleased to note the Fiscal Authorities efforts in discontinuing Ways and Means advances. This is also in compliance with Section (38) of the CBN Act (2007), the Bank is no longer at liberty to grant further Ways and Means advances to the Federal Government until the outstanding balance as of December 31, 2023, is fully settled.

“The bank must strictly adhere to the law limiting advances under ways and means to five percent of the previous year’s revenue.

“We have also halted quasi-fiscal measures of over N10tn by the Central Bank of Nigeria under the guise of development finance interventions which hitherto contributed to flooding excess Naira and raising prices to the levels of Inflation we are grappling with today,” he said.

Discover more from The Source

Subscribe to get the latest posts sent to your email.