The Central Bank of Nigeria, CBN has cited the need to boost cross border trade as one of the reasons it introduced e-Naira also known as CBDC.

The digital currency is billed to take off next month and the apex bank has directed business owners and merchants to accept it as a mode of payment.

Apart from boosting cross border trade, the apex bank said

e-naira will boost the nation’s digital economy, as well as an enabler for macroeconomic policy formulation.

According to Director, Information and Technology, CBN, Rakitya Muhammed, the introduction of the e-naira can catalyse Nigeria’s digital economy, boost cross border trade and enable better macroeconomic policy formulation.

Rakiya Muhammed, CBN Director, Information and Technology, who spoke at the Third Quarter Industry Forum of the Committee of E-business Industry Heads in Abuja on Wednesday said by accepting e-Naira Nigerians are assisting the federal government to formulate good policies.

According to Mohammed “If people adopt more of the usage of the e-naira, then we will be able to have more data to formulate better macroeconomic policies.

“And when countries come on board and create their own digital currencies then we will be able to have faster exchange of currencies and therefore we might be able to boost cross border trade at a much lower cost.

“Of course payment efficiency, even though we know that Nigeria has one of the best payment systems in the world, we will still be able to improve on that.

“We believe that the e-naira will be a catalyst for digital economy because the people who are outside the formal banking sector will be integrated.”

She said the e-Naira will serve the same purpose as Naira as the nation’s legal tender because “in terms of the e-naira design, it will be a legal tender just like cash which is one of the fundamental difference between it and the cryptocurrency.

“One e-naira will be equal to one fiat naira, and we adopted a two-tier retail model that would be a lot less disruption into the financial system.

“Our banks, payment service providers and fintech are all going to be onboard and we are going to key to the infrastructure they have already and incorporate the new system.

“It is not meant to replace the cash me have only to supplement.”

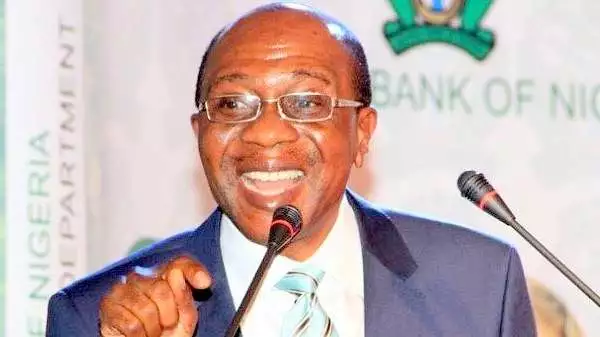

The CBN Governor Godwin Emefiele announced in July that the e-Naira will become a legal tender from October 1.

Discover more from The Source

Subscribe to get the latest posts sent to your email.