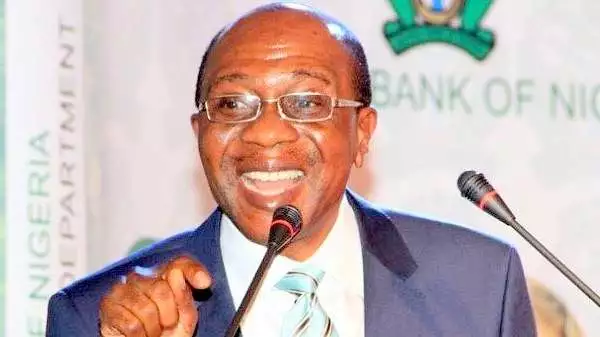

The Central Bank of Nigeria, CBN governor Godwin Emefiele has urged Nigerians to take advantage of licensed micro finance banks rather than obtaining loans from illegal money lenders. Emefiele said CBN has decided to go after the illegal lenders to save many Nigerians, adding that the lenders ‘will be dealt with mercilessly” when caught.

According to him, the illegal money lending firms, mostly run Chinese nationals have been exploiting as a result of the interest they charge and their crude recovery of loans in case of default. The situation, the apex bank governor said cannot continue.

Emefiele disclosed this in Abuja on Tuesday after the monthly Monetary Policy Committee, MPC meeting in Abuja.

He said the lenders also known as loan sharks have exploited unsuspecting Nigerians for too long, noting that “people normally go to loan sharks because they are desperate and can’t access the bank”.

He said “we found out that those that are vulnerable are households who need money to do their businesses but they can’t access bank finance and as a result go to loan sharks who charge them way above or two times higher than the amount borrowed and expected to pay back in 90 days and if that doesn’t happen, they seize your house or bikes.

“We can only continue to advise that there is no need to go for loan sharks. The central bank has put in place the avenue through which you can raise your finance, like through the target credit facility or the SMEs loan that was set up through our microfinance banks.

“You don’t have to owe anybody, just go to the portal and fill the form, send your data, and if it’s correct, you will be able to access loans.”

He said the micro finance banks are still the surest and reliable sources of getting loans by individuals and business owners.

“We have a large number of people who have testimonials from the facilities we’ve made available and do not have to owe anybody,” Emefiele said.

Meanwhile, the apex bank governor disclosed after the end of the MPC meeting that the committee agreed to retain the Monetary Policy Rate, MPR of interest rate at 11.5 per cent.

Other parameters left unchanged are the Cash Reserve Ratio and Liquidity Ratio at 27.5 per cent and 30 per cent respectively.

“After a careful balancing of the benefits and the downside risks of the policy options, the MPC decided to hold all parameters constant, believing that a whole stance will enable the continuous permeation of current policy measures in supporting the recorded growth recovery and further boost production and productivity which will ultimately rein in inflation in the short to medium term.

“The MPC thus decided by a unanimous vote, the MPC voted as follows, one, retain MPR at 11.5 per cent; retain the asymmetric corridor of +100/-700 basis points around the MPR; retain the CRR at 27.5 per cent; and retain the Liquidity Ratio at 30 per cent,” Emefiele said after the end of the first MPC meeting for the year.

Discover more from The Source

Subscribe to get the latest posts sent to your email.