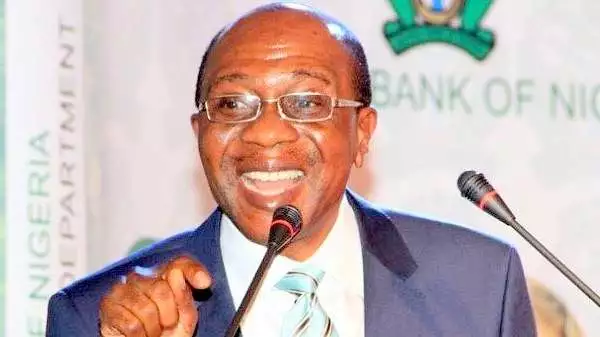

The Godwin Emefiele-led Central Bank of Nigerian, CBN has accused the federal government of excessive borrowing from the government owe’new bank. The apex bank said the Buhari administration has borrowed too much from the bank, through the Ways and Means, W&M, and that the action is frustrating the CBN’s Monetary policies. The Federal government currently owes the CBN N15.5 trillion, a substantial part of that amount N14.8 trillion has so far been borrowed under the Buhari administration.

According to the CBN Act (as amended ) the federal is allowed to borrow five percent of the previous year’s estimate to finance budget deficit, but such must repaid before the end of the fiscal year, the extant law said. Notedly, the Buhari administration has abused the process, making it the highest CBN’s debtor ever, critics of the government said.

Recall that Rotimi Amaechi, the Minister of Transportation was quoted as saying that President Buhari had informed his kitchen cabinet of his government’s resolve to borrow more from the apex bank as soon as he came to office in 2015.

In its report of February 2021, the International Monetary Fund, IMF warned the CBN to stop financing government’s budget deficit. The Fund had earlier in 2019, warned that huge fiscal deficits financing will complicate CBN’s monetary policy.

Also last year, globally respected body Fitch Ratings, warned that federal government’s frequent recourse to the apex bank to borrowing to finance budget deficits put Niger at the risks of macroeconomic instability.

The CBN on its part has refused to own up to the abuse of the W&M overdraft until lately. According to Nairametrics, while responding to a question on its Frequently Asked Questions page the CBN S said the federal government has frustrated it’s monetary policy as a result of complete disregard to the limit set by the law on the W&M overdraft.

On whether the federal government’s complete disregard for the CBN Act is having a toll on its monetary policy the apex bank said “Yes when the Federal government exceeds its revenue, the CBN finance government deficit through Ways and Means Advances subject (in some cases) to the limits set in the existing regulations, which are sometimes disregarded by the Federal Government.

“The direct consequences of the central bank’s financing of deficits are distortions or surges in the monetary base, leading to an adverse effect on domestic prices and exchange rates i.e macroeconomic instability because of excess liquidity that has been injected into the economy.”

”The ultimate goals of monetary policy are basically to control inflation, maintain a healthy balance of payment position in order to safeguard the external value of national currency and promote adequate and sustainable level of economic growth and development. These goals are achieved by controlling money supply in order to enhance price stability (low and stable inflation) and economic growth.“

Meanwhile, critics of the Emefiele-led bank said the management of the bank must have been seriously hit by the slew of criticisms among Nigerians that it is culpable in the Buhari administration’s flagrant abuse of CBN’S Act regarding the W&M window. Therefore, its latest stand on the issue, they insist, may not go without a serious backlash from the presidency.

Last year, a coalition of civil society organisations , CSO demanded the resignation of Emefiele as CBN Governor after criticising his monetary policies which they said have impoverished many Nigerians.

Discover more from The Source

Subscribe to get the latest posts sent to your email.