The Central Bank of Nigeria, CBN, says it has increased official interest rate ahead the removal of fuel subsidy by the federal government.

The Buhari administration had set June this year for the total removal of subsidy on petrol, despite fear among Nigerians that doing so will push up the prices of goods and commodities across the country.

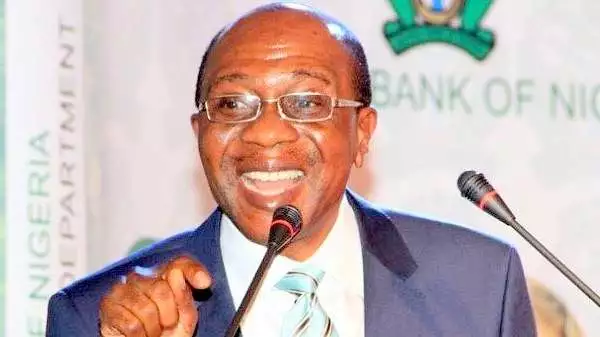

The CBN Governor, Godwin Emefiele said during the Monetary policy committee, MPC, meeting on Tuesday that it has increased the interest rate by 50 percent basic point to 18 percent from 17.5 percent January figure.

This, Emefiele said, became necessary in the expectation that fuel subsidy will be removed by the middle of the year, which may likely push up prices of basic commodities.

He explained that the previous measures taken by the apex bank to tame inflation worked out, adding that the CBN needed to sustain the gains by slightly increasing the interest rate.

According to him, 10 out of the 12 MPC members supported the decision to raise the interest rate.

Emefiele said, “Loosening in the view of the committee members would undermine gains so far achieved.

“MPC observed the upward risk to price development and expectations of the removal of the Premium Motor Spirit (PMS) subsidy.

“These, in the view of members, provide a compelling argument for an upward adjustment of policy rate, albeit less aggressively.”

The National Bureau of Statistics, NBS, had in January said the nation’s headline inflation fell slightly to 21. 34 percent from the 21. 47 percent December figure.

This followed a sharp rise for 11 months, January to November, 2022 before it finally fell in December.

Meanwhile, opinion are divided on whether the prices of goods and commodities have actually gone down, bearing in mind the report by the NBS, on Tuesday that fuel prices have risen by over 54 percent in two years.

In Nigeria, the price of petrol and diesel have significant effects on the prices of other basic households commodities, the higher their prices the higher the cost of other goods.

Discover more from The Source

Subscribe to get the latest posts sent to your email.