Central Bank of Nigeria (CBN) has pegged naira exchange rate at 386 units to the United States dollar, in what stakeholders consider a move to arrest the naira from further sliding southwards.

The apex bank has also resumed the weekly forex sales to Bureau de Change, BDC operators from next Monday, August 31.

In the new regime, the volume of sale to each market is $10,000 per BDC, while trading will be done on Monday and Wednesday, according to a circular from the government bank.

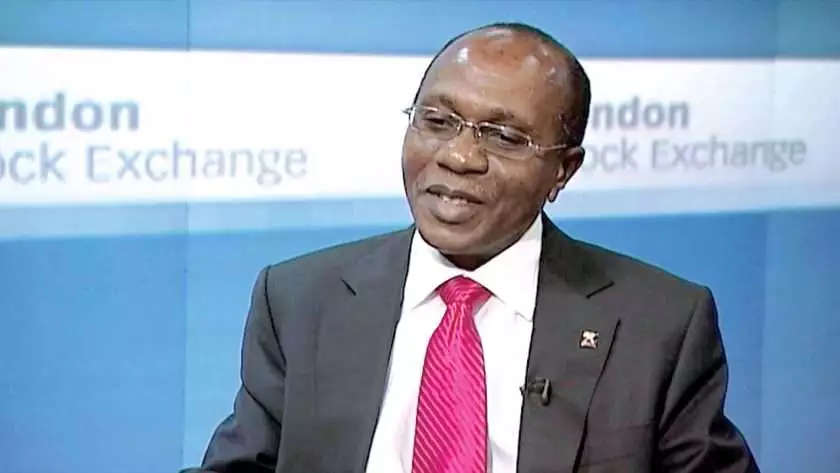

The Godwin Emefiele led CBN had on March 25 announced the suspension of forex sale to BDCs as parts of measures aimed at reducing person-to-person contact and curbing the transmission of the coronavirus (COVID-19).

The measure, experts say has brought untold hardship to those in need of forex to transact business thus putting pressure on the National Currency, leading to thriving business for market speculators.

The forex sales to BDC will remove those bottlenecks and enhance more access for those that really need foreign currency, the CBN said in a circular on Thursday.

According to the document signed by O.S. Nnaji, director of trade and exchange department, the apex regulator said forex sales to BDCs will enhance accessibility for travelers.

CBN said “Please be advised that the applicable exchange rate for the disbursements of proceeds of IMTOs for the period Monday, August 31 to Friday, September 04, 2020, is as follows: IMTSOs to banks: N382/$1; Banks to CBN: N383/$1; CBN to BDCs: N384/$1; BDCs to end-users : Not more than N386.

The apex bank directs the BDC “to ensure that their accounts with the banks are duly funded with the equivalent naira proceeds on Fridays and Tuesdays.”

The bank “shall continue to sell foreign currencies for travel-related invisible transactions to customers and non-customers over the counter upon presentation of relevant travel documents (passport, air ticket and visa),” the circular said.

Discover more from The Source

Subscribe to get the latest posts sent to your email.