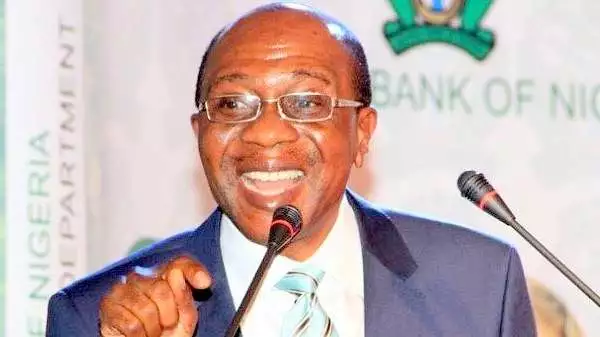

The Godwin Emefiele-led Central Bank of Nigeria, CBN has directed commercial banks in the country to block illicit drug proceeds front Republic of Benin. The apex bank said the banks must activate firewalls to prevent drug-related funds from the West African neighbour which has now become a hub for drug dealers, from entering the country.

The development came barely two weeks after the National Drug Law Enforcement Agency, NDLEA arrested billionaire drug kingpin Afam Mallinson Emmanuel Ukatu who was behind the N3 billion Tramadol deal linked to Abba Kyari, the disgraced former head of Intelligent Response Team, IRT.

Ukatu who is Chairman of Mallinson Group of Companies was eventually nabbed onboard a flight to Abuja at the MM2 terminal of the Lagos airport, Ikeja on April 13 several months after evading arrest by the anti-narcotic agency.

The magazine learnt from competent sources in CBN that the apex regulator has now stepped up collaboration with NDLEA with the aim of blocking illicit drugs related funds from getting passage into the country from neighbouring African nations.

The top financial regulator said it will hold any bank responsible for breech of this directive, adding that it has discovered that some criminals are trying to use the French speaking nation as a transit point of flushing Nigeria with drug money.

CBN, in a circular dated April 11 and signed by Asuquo Evelyn, Director of Banking Supervision department, said the order became necessary to stop Nigerian from being used as warehouse for dirty drug money.

It has, therefore, urged money banks and other financial institutions to strengthen their Know- Your Customers as well as customers due diligence mechanisms.

The circular said “We write to bring to your attention an intelligence report availed to the Central Bank of Nigeria (CBN) which indicated that the Benin Republic is increasingly becoming a drug trafficking transit and consumption hub in West Africa,” the circular reads.

“In order to ensure that Nigerian banks are not used as conduits for laundering such illicit funds, it has become imperative to intensify the know-your-customer (KYC) and customer due diligence (CDD) measures in your bank as required by regulation.

“Consequently, you are required to implement additional measures on customers and business relationships linked to the Benin Republic. You are also required to re-classify related customers and transactions as high risk and conduct enhanced due diligence (ED) procedures accordingly.”

Discover more from The Source

Subscribe to get the latest posts sent to your email.