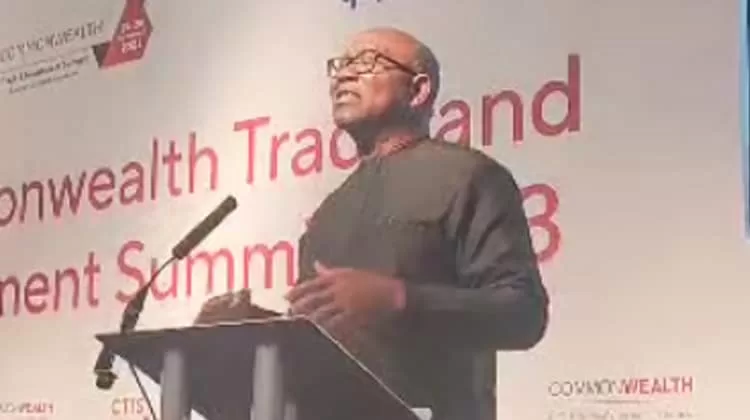

Peter Obi, the presidential candidate of the Labour Party in the last election has criticised the Central Bank of Nigeria, CBN, for increasing the interest rate.

The monetary policy rate, MPR, was increased during the Monetary Policy Committee, MPC, meeting on Wednesday.

The magazine reports that the Yemi Cardoso-led CBN raised the interest rate by 400 basic points to 22. 75 per cent from 18.75 percent.

According to Obi, the hike in the interest rate will worsen the economic situation in the country.

He explained that the decision will also lead to huge job loses, adding that the policy is counterproductive, in the sense that it will not affect money supply in the economy.

In a statement the LP party presidential candidate posted on his X handle today, Obi said the “manufacturing and other sectors” will be worse hit by the CBN decision.

He said: “I am of the strong opinion that the recent decision of the Monetary Policy Committee to increase the onetary policy rate (MPR) to 22.5% and the cash reserve ratio (CRR) to 45% will further worsen the economic situation of most Nigerian households as it is bound to cause more job losses in the productive sector, especially manufacturing and other sectors that rely on bank loans and credit facilities for their funding needs.

“Tightening liquidity in the financial system does not improve productivity, ie food production, which is the major cause of inflation in Nigeria.

“Moreover, only about 12% of N3.6 trillion of the total money in circulation is in the banking system which means that 88%, about N3.2 trillion is outside the banking system.

“So, this measure would rather be counterproductive as it would not address the intended purpose of managing the money supply.

“These new measures will worsen the fragile economy as the supply of funds would dry up for the real sector, and the new MPR rate hike will push the interest rate on loans to above 30%, which would be very difficult for the real sector operators especially manufacturers and SMEs to repay; resulting, obviously, in increased bad loans, and worsening the nation’s economic situation.”