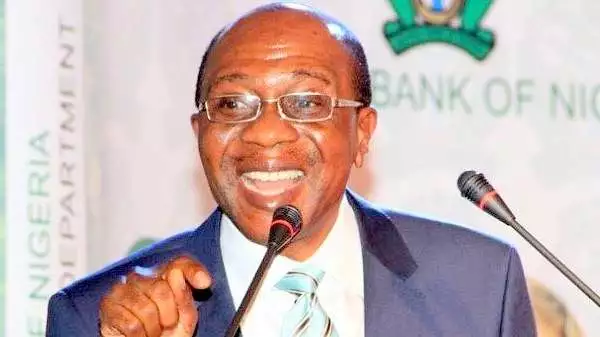

The CBN started selling foreign exchange to commercial banks in the county last July despite strict warning by keen watchers of the Godwin Emefiele-led government bank that the regime is unsustainable. Critics of the CBN Governor, in their scathing remarks against the policy said then that the decision to sell forex to banks is one of the trial and error efforts, and not a deep end-to- end framework by the bank to save the nation’s sliding foreign reserves and stabilise the naira.

They said further that the regime will be marked by serious coruption as the apex bank will not be able to monitor the banks to know whether the forex are being sold to genuine end users. Some measures put in place then by the CBN was to set up forex desks in all the banks, apart from issuing warning to banks chief executives that anyone caught in the web of forex racketeering will be severely punished.

The analysts seemed to be right considering that the apex bank has now made a u-turn barely eight months after. Emefiele said yesterday in Abuja that the regime is no longer sustainable and would end by the end of the year.

The development also comes on the back of revelation, on Wednesday, by the bank that Diaspora weekly remittance has increased from about $6 million in 2020 to $100 million in 2022.

But this appears not to have a positive impact on the nation’s foreign reserve which has been on the slide since the beginning of the year, analysts said.

For instance, the chief executive officer of Financial Derivatives Company, Bismarck Rewane, said last month that the forex reserve would drop to $39 billion by the first quarter of the year, citing demand for forex and pressure on the Naira. By last week, the figure has dropped from the month long $40 billion even as the country’s foreign reserve monitors paint a more gloomy outlook before the first half of the year.

“Even with the rising crude oil prices in the international market, the CBN must engage in serious engagement and positive framework that will ensure the stability of Nigeria’s foreign reserve. All stakeholders must be involved this time around, and if possible a think thank set up to draw the way forward,” Princewill Duke, an analyst said on Friday.

The govrnment bank stared selling forex to banks in July last year after it accused bureau the change, BDC of sponsoring terrorists and other criminal groups in the county.

Emefiele said then that the apex bank took the decision because BDC operators “have turned themselves away from their objectives They are now agents that facilitate graft and corruption in the country.We cannot continue with the bad practices that are happening at the BDC market.”

But months after, the apex bank said it will end the regime of forex sale to banks soon. Emefiele who spoke during the launch of the bank’s new forex repatriation scheme, RT200, held after the Banker’s Committee meeting on Thursday, in Abuja, said the CBN will end forex sale to banks by end of the year, adding that banks should begin to source for their forex independently.

Speaking on Thursday, Emefiele disclosed that commercial banks have become lazy in sourcing for forex for their customers, noting that they cannot continue to rely on the bank.

“The era is coming to an end when, because your customers need 100million dollars in foreign exchange or 200 million dollars, you now want to pack all the dollars and pass it to CBN to give you dollars.

The regime of forex sale to banks “is coming to an end before or by the end of this year. We will tell them don’t come to the Central Bank for foreign exchange again go and generate your export proceeds.

“When those export proceeds come, we will fund them at 5% for you and they will earn rebait. Then you can sell those proceeds to your customers that want 100 million dollars. But to say you will continue to come to the Central Bank to give you dollars, we will stop it,” the CBN boss said.

He explained that the decision is in line with the CBN’s new commitment to boost the country’s foreign reserves through proceeds from non-oil exports.

“Nigeria cannot continue to depend on FX earnings to fund its import obligations from revenue coming from earnings from products where we cannot determine both price and quantity,” he said.

Meanwhile, the CBN Governor disclosed on Thursday that it policies and measures have led to a significant increase in Diaspora remittances after it slowed during the COVID 19 pandemic. Emefiele said policies such as the N1 trillion facility in loans to boost local manufacturing and production across critical sectors of the economy led to surge in diaspora remittances.

Discover more from The Source

Subscribe to get the latest posts sent to your email.