The Central Bank of Nigeria (CBN) has released N1.079 trillion under the Anchor Borrowers Programme, (ABP) since the programme commenced eight years ago.

The ABP is one of the steps being taken by the present administration to boost food production and assist small scale farmers.

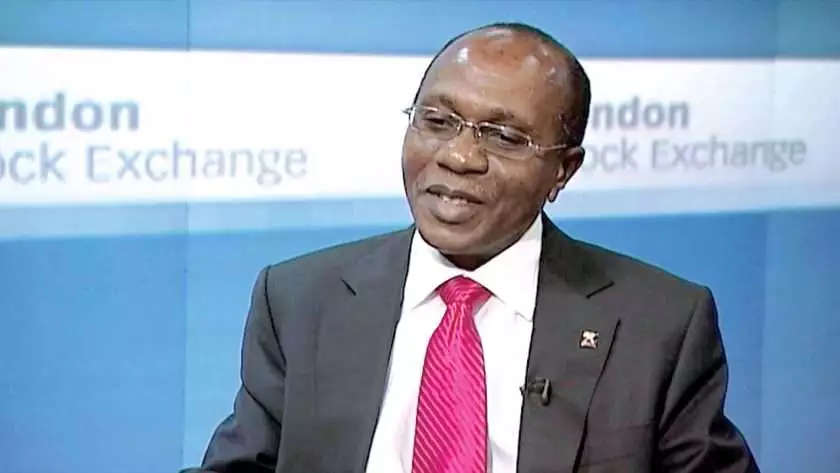

Acting director, corporate communications of the CBN, Abdulmumin Isa, who disclosed this in a statement in Abuja on Monday also revealed that out of amount, N960 biillion is due for repayment.

He explained that repayment of loans under the ABP stood at N503 billion, representing 52.39 per cent, till date.

Isa stated that the apex bank remained committed to its developmental mandate of stimulating access to finance for the real sector.

He said that the ABP had supported about 4.57 million smallholder farmers who cultivated over 6.02 million hectares of 21 commodities across the country.

Isa listed the commodities as rice, wheat, cowpea, millet, maize, cotton, fish, soya bean, poultry, cassava, groundnut, ginger, sorghum, oil palm, cocoa, sesame, tomato, castor seed, yellow pepper, onions, and cattle/dairy.

He explained that the ABP had contributed significantly to the increased national output of focal commodities, with maize and rice peaking at 12.2 and 9.0 million metric tonnes in 2021 and 2022 respectively.

According to him, the programme has also helped to improve the national average yield per hectare of the commodities, with productivity per hectare almost doubling within the eight years of the programme’s implementation.

The acting director, disclosed that repayments under the ABP have been made through cash or produce by the beneficiaries.

“The outstanding due balance on loans was still under moratorium due to the COVID-19 forbearance granted to beneficiaries of the apex bank’s interventions in March 2020 and extended to Feb. 28, 2022.

“It is pertinent to note that the tenor of loans under the ABP is based on the commodity gestation period.”

Discover more from The Source

Subscribe to get the latest posts sent to your email.