The Central Bank of Nigeria, CBN says its digital currency aka E-Naira would enhance financial stability in the country rather than disrupt the existing structure of the banking system.

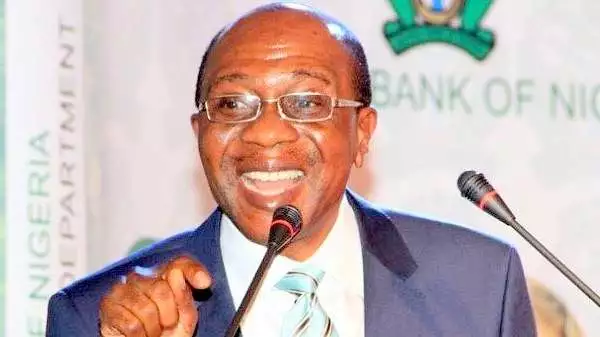

The Godwin Emefiele-led apex bank had in July set October 1 for the digital currency to take off, noting that the country cannot be left behind as about 80 percent of central banks globally are currently exploring the possibility of issuing their central bank digital currency, CBDC.

Rakiya Mohammed CBN’s director of information technology, on June 10, disclosed that the apex bank would introduce digital currency before the end of this year as “officials of the CBN have been exploring digital currency technology for over two years.”

But financial experts have expressed reservations about the E-Naira, particularly the concerns that the national digital currency will make it difficult for private cryptocurrency to compete, due to the fact that the CBN e-cash would be operated, backed and controlled directly by central banks, as such would be preferable to private cryptocurrencies.

However, other analysts insist that since it will be controlled by the CBN, the national digital currency would promote a seamless cash transaction.

Others have also argued that the E-Naira is another way by CBN to increase forex flow, as the country battle dollar shortages.

Speaking at a stakeholders meeting in Abuja on Thursday, Deputy Governor, Operations Directorate, CBN, Folashodun Adebisi Shonubi, assuaged fears that digital currency will lead to financial disruptions.

Shonubi spoke at the Chartered Institute of Bankers’ of Nigeria, CIBN, Advocacy Dialogue Series Four, where stakeholders converged virtually to discuss, “Central Bank Digital Currencies (CBDC): Insights for the 21st Century Banker.”

He explained that digital currency is a cheaper alternative to cash, as well as for electronic form of payment, adding that the CBN has no intention of strangulating other forms of payments.

According to him “the intention is not to eliminate the use of other forms of payment, but simply to introduce a complement to the current options, areas of payments options that we have in the country and all over the world.

“This will enable effective competition and the natural evolution of payment option, policies and all that, thereby ensuring the safety and stability of the payment system in the long run.”

E-Naira will not disrupt other forms of payments, he said.

“In my opinion, we believe the CBDC will not disrupt the existing banking and payment landscape. No, banks and other fintechs will not be disrupted, rather, it will provide them with another platform to innovate around the new money with the opportunity to leverage the enabling infrastructure and platforms to develop value added services such as programmable smart contracts microcredits savings payments, etc,” he said.

What impacts would the National digital currency have on the banking sector?

The CBN chief said “this will further strengthen the banking system, especially, central banks globally, who have identified the need to ensure that banks are integral in the operation of CBDC. The risk of disintermediation, I believe, will be assuaged even as banks take their rightful place in the dynamics of operation of CBDC. I am of the opinion that CBDC will strengthen the stability of the banking system even as the person becomes more diversified”

He further explained that the E-Naira would generally improve efficiency and promote opportunities for jurisdictions without instant payment options to benefit from faster payment system.

“The CBDC is expected to enhance efficiency in international remittances and address the challenge the current high cost of remittances. As remittance flow improves, the deposit base of the banks in receiving countries will also improve as one of the key benefits of the CBDC,” the CBN Deputy Governor said.

Discover more from The Source

Subscribe to get the latest posts sent to your email.