By Fola James

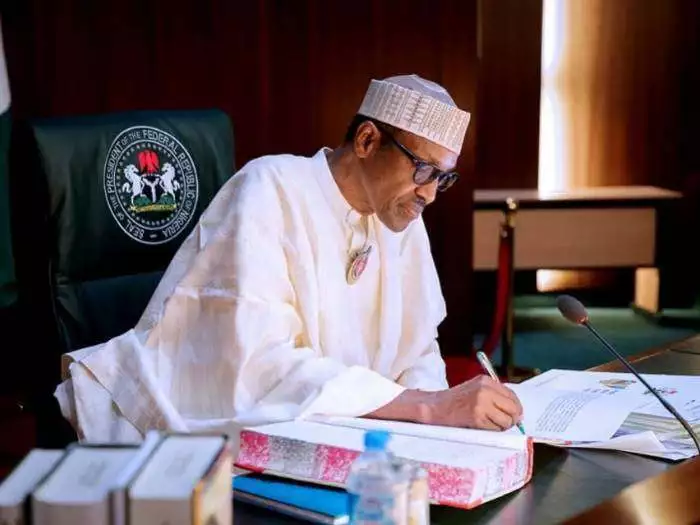

President Muhammadu Buhari, on Monday, signed the 2020 Finance Bill into law, the major focus being the increase of value added tax by 50 percent.

Nigerians will now pay 7.5 percent rather than the five percent they have paid as VAT for many years.

In spite of fears in the private sector that prices of goods may double, the federal government said, the increase will free up more resources for infrastructural development.

The cost of essential consumables is likely to rise tremendously, with impact on inflation, some have said.

But the government said there are more benefits in the bills for Nigerians.

The Special Adviser to the President on Media and Publicity, Femi Adesina, in a statement said the 2020 budget can now run smoothly without any hitch.

According to the presidential aide, this is sequel to the passage of the finance bill by the National Assembly and subsequent assent by President.

Recalled that the retired general, while presenting the 2020 Appropriation Bill to the National Assembly, had also presented the Finance Bill.

Adesina said, “This Finance Bill has five strategic objectives, in terms of achieving incremental, but necessary, changes to our fiscal laws.

“These objectives include; promoting fiscal equity by mitigating instances of regressive taxation; Reforming domestic tax laws to align with global best practices;

“Others are; Introducing tax incentives for investments in infrastructure and capital markets; Supporting Micro, Small and Medium-sized businesses in line with our Ease of Doing Business Reforms; and Raising Revenues for Government.”

He explained that “The draft Finance Bill proposes an increase of the VAT rate from five per cent to 7.5 per cent , as such, the 2020 Appropriation Bill is based on this new VAT rate.”

With the assent, Adesina stated, there would be more revenue to finance key government projects especially in the areas of health, education and critical infrastructure.

Discover more from The Source

Subscribe to get the latest posts sent to your email.