Bank’s workers aiding illicit financial funds into the country are set for a rough time if the House of Representatives succeed in passing the BOFIA Act currently before the lower house of the National Assembly. On Tuesday, the bill passed the second reading and will now go through the Committee stage after which the Committee of Whole would delibarte on in before it can be sent to the president for his assent.

The amendment bill is sponsored by Abiolz Shina representing Oyo State in the House.

The bill, checks reveal seeks to prescribe various punitive measures for employees of financial institutions such as banks, insurance companies, mortgage firms and others who will connive with criminal elements to funnel illicit capital into the country. It was also learnt that rogue bureau de change operators will also be captured in the bill, after it was revealed recently by the Central Bank of Nigeria, CBN that some BDC firms are assisting foreigners who are aiding terrorism and criminality financing.

Dozens of BDC operators were operated last April in a sting operation conducted by multiple security agencies such as the Defence Intelligence Agency, DIA, Department of State Services, DSS, Nigerian Financial Intelligence Unit, NFIU in collaboration with the CBN. Many of them are aleady being prosecuted, according to official sources.

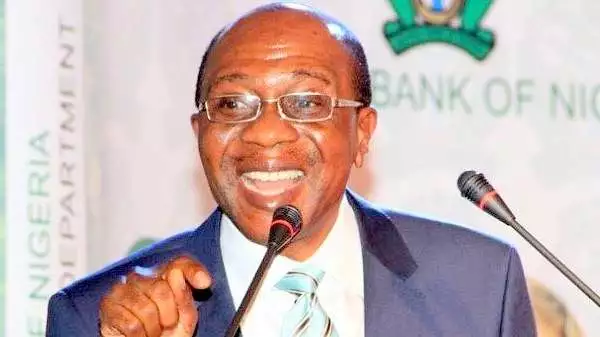

Following the closely garded operations, several billions of naira traced to businesses belonging to persons of interest have been blocked in many commercial banks. More accounts have since been flagged for investigation on the order of the Godwin Emefiele-led CBN and NFIU.

But analysts informed the magazine that the current law only prescribed a slap on the wrist punishment for financial criminals who have been growing in numbers capitalising on the gaps in the law. Apart from this, financial analysts insist that new laws are required to govern Nigeria’s ever expanding financial sector.

Speaking on the amendment, the Chairman of the House Committee on Financial Crimes, Ibrahim Abdullahi who briefed journalists in Abuja, the nation’s capital said the national assembly must move fast in the face of growing incidents of banks employees aiding illicit financial inflows into the country.

Abdullahi who said the bill, when passed will checkmark the excesses of employees of financial institutions the present Act has become archaic and is no longer in tune with present realities considering the number of financial institutions in the country. He explained that the growth experienced in the sector has surpassed what it was four decades ago, noting that apart from banks, other financial firms such as Pension Funds administrators, Insurance firms, have been established by both government and private parties.

According to him, “the Act was promulgated under the military era and as such, carries with it, some elements of that regime, hence the significance of this Amendment.

“Today, we have a proliferation of insurance companies, mortgage banks, Pension Fund Administrators and even lending organizations etc. who equally require supervision like banks”

“Accordingly, Clause 1, sub-clause (1) of the Bill seeks to compel employees of a bank to immediately declare their assets including those of their spouses and unmarried children under the age of 18years.

“The bill also amends the existing legislation by inserting a new Clause which attempts to ban bank employees from maintaining and operating personal bank account in any country outside Nigeria. Clause 3 of the Bill also seeks to mandate the President to direct by a published instrument,” Abdullahi said.

Meanwhile, the Senatemail on its part to amend the Act has also included a clause which makes it punishable for bank workers to operate foreign accounts.

Discover more from The Source

Subscribe to get the latest posts sent to your email.