“Our focus is to become an aggregator in Africa and we are building a global payment gateway and providing trade finance support and correspondent banking across the continent.”

By Babajide Komolafe

The resilience of the Nigerian banking industry in the face of economic recession triggered by the COVID-19 pandemic is reflected in the financial performance of Access Bank Plc for the year ended December 2020. In a pandemic ravaged year that saw the global economy contracting by about 4.3 per cent and the Nigerian economy suffering 1.92 contraction, Access Bank was able to record significant increase in revenue and profitability. According to the audited financial statements of the bank, gross earnings increased by 15 per cent, to ₦764.7 billion in 2020 from N666.75 billion in 2019.

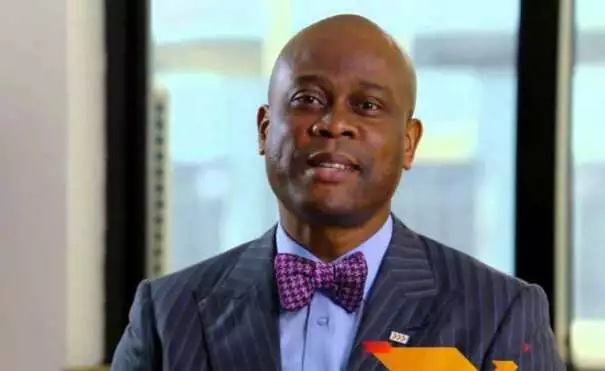

The bank recorded 13 per cent growth in Profit Before Tax (PBT) to ₦125.9 billion in 2020 from ₦111.9 billion in 2019. The above led to 22 per cent growth in the bank’s total assets which grew to ₦8.68 trillion in December 2020, from ₦7.14 trillion in December 2019. The above performance, according to Herbert Wigwe, Managing Director, Access Bank Plc, especially at a time of general decline in economic activities, upsurge in job losses and business failures, was made possible by the strong focus of the bank on retail banking, financial inclusion and an African expansion strategy.

Retail & E-Payment

Growth Reflecting the effectiveness of the bank’s focus on retail banking on its financial performance in 2020, the bank attracted 5.8 million new customers while Customer deposits grew by 31 per cent to ₦5.59 trillion in 2020 from ₦4.26 trillion in 2019, with Savings Deposits rising 66 per cent to N1.3 trillion in 2020 from N789 billion in the previous year. The growth in the bank’s retail banking in 2020 was enhanced by the expansion of its electronic banking offerings leading to significant increase in transaction value across its various e-payment channels.

These include: 116 per cent growth in USSD transactions to N1.9 trillion in 2020 from N891 billion in 2019; 55 per cent growth in POS transaction to N798 billion from N515 billion; 24 per cent growth in ATM transactions value to N3.09 trillion from N2.49 trillion; and 40 per cent growth in Mobile & Internet transaction value to N24.03 trillion i 2020 from N17.2 trillion in 2019. Consequently, income from e-payment channels and e-business rose by 56 per cent to N56.1 billion in 2020 from N36 billion in 2019. Following the growth in customer deposits and e-payment channels, Access Bank was able to grow its non-interest income by 112 per cent to N275.5 billion in 2020 from N129.91 billion.

The triple digit growth in non-interest income helped the bank to overcome 5.0 per cent decline in interest income, which fell to N262.95 billion in 2020 from N277.2 billion in 2019, a by-product of the crash in interest rates in 2020. In addition to the above, Access Bank recorded significant improvement in assets quality as reflected in its Non Performing Loan (NPL) ratio.

Speaking in this regard, Wigwe said: “Our asset quality also continued to improve as guided to 4.3 per cent from 5.8 per cent in 2019 as we intensified recovery efforts, undertook significant write off and leveraged our robust risk management practices This is expected to continue to trend downwards as we strive to surpass the standard we had built in the industry prior to the merger with Diamond Bank.”

Elaborating on the factors behind the growth recorded by the bank in 2020, Wigwe said: “The strategic actions that the bank has taken over the past 12 months evidence a strong focus on retail banking and financial inclusion, an African expansion strategy and a drive for scale for sustainable value creation. “In 2020, Access Bank proudly opened its doors for business in Kenya and Mozambique, further increasing our footprints across the African Continent. Access Bank Zambia also concluded the acquisition of Cavmont Bank Limited in January 2021 and the Group recently announced the approval by relevant regulatory authorities for the acquisition of Grobank Limited, creating an inroad into the South African market in realization of the Group’s strategic ambitions.”

Transition to HoldCo

To further sustain the growth achieved in 2020 and give momentum to its African expansion strategy, Access Bank recently announced its intention to transit to a Holding Company (Holdco) structure. According to Wigwe, this move is motivated by the opportunities that further exist in the market. He said: “The bank has received the Approval-In-Principle from the Central Bank of Nigeria for the restructuring and the HoldCo will consist of 4 subsidiaries in order to tap into the market opportunities that are available in the consumer lending market, electronic payments industry and retail insurance market.

“The proposed HoldCo structure would enable the Bank to further accelerate its objectives around business diversification, improved operational efficiencies, talent retention as well as robust governance. The new Access Bank Group will consist of Nigeria, Africa and international subsidiaries, while the payments subsidiary will leverage the strong suite of the bank’s assets.

“Going into the fourth year of our 5-year cyclical strategy, our focus remains on consolidating our retail momentum and expanding our African footprint in a sustainable manner.”

AfCFA Opportunities

Among the market opportunities encouraging the Pan African expansion strategy of Access Bank is the African Continental Free Trade Area (AfCFTA) which commenced this year. Releasing the need to support the regional initiative and also take advantage of the opportunities it offers, Access Bank recently unfolded plans to expand to eight more African countries. The countries are Morocco, Algeria, Egypt, Ivory Coast, Senegal, Angola, Namibia and Ethiopia. Presently, the tier-one bank operates in 12 countries. According to Wigwe, across Africa, there is an opportunity for the bank to expand to high-potential markets, leveraging the benefits of AfCFTA.

He further noted that, AfCFTA, among other benefits, would expand intra-Africa trade and provide real opportunities for Africa. Wigwe said the bank would use its office in London to expand representative offices in India, Lebanon and China. He stated that the plan is for the bank to establish its presence in 22 African countries so as to diversify its earnings and take advantage of growth opportunities in Africa.

According to him, Africa has enormous potential and there are opportunities for an African bank that is well run, that understands compliance and has the capacity to support trade and the right technology infrastructure to support payments and remittances, without taking incremental risks. “We believe that we are best positioned to basically do all of that. Our focus is to become an aggregator in Africa and we are building a global payment gateway and providing trade finance support and correspondent banking across the continent. We are focusing on the key markets.

“The approach would always be that in the country we wish to go to, that we have the right skills. We would not just be a drop in the country in which we are present, we would make sure that we have an impactful presence in each of the major countries in which we are present.

“In doing this, we are also mindful of the country we are going to so as to make sure that it is of benefit to the bank. As we do this, we are working with our friends and partners. “We are diversifying our earnings away from volatile markets as well and we are orchestrating our operations from the global payments gateway and ensuring that using Access Bank UK, providing corresponding services from digital platforms, the overall profitability of our franchise,” he explained.

Commenting further, on AfCFTA, he said the bank would use its digital framework to benefit from the deal. “Coming to Nigeria, we think we need to continue to entrench ourselves in the local market because there is still so much work to be done. “So, we are doing everything possible to satisfy our customers and also to ensure that our channels are adequately secured.

We are also ensuring that our staff are very efficient,” the CEO said. In 2018, the bank launched its ‘Africa’s Gateway to the World’ campaign – a strategic initiative which aims to promote ‘access to finance’ in Africa and beyond. It started this campaign by leveraging technology to offer its consumers new products. An example was its partnership with Remita, which has offered PayDay loans to over five million external customers.

The product was available on the web, through the bank’s USSD code, via ATMs, Access Mobile, WhatsApp Banking, and QuickBucks – its instant loan disbursal application. Access Bank has also embraced digital technology to propel both its sustainability targets and its African gateway strategic drive.

Discover more from The Source

Subscribe to get the latest posts sent to your email.