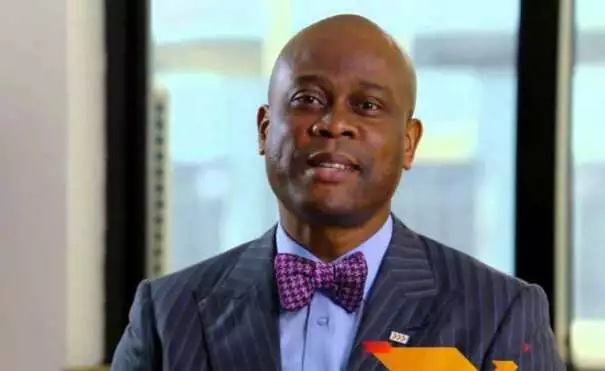

The bullish approach of Access Bank Plc in acquiring big banking brands in the country is unequalled, some experts have noted, following reports that the Herbert Wigwe-led bank is planning to acquire businessman Bob Diamond’s 50 per cent shares in Union Bank Plc to become the new owner of the one of the oldest financial institutions in the country.

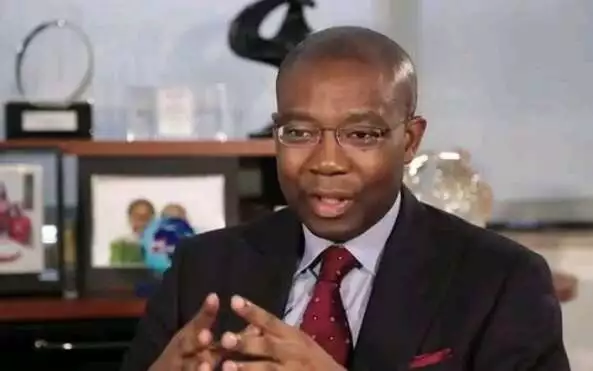

If the deal succeeds, even though the lender has denied planning to acquire the Emeka Emuwa led bank, analysts say Access bank would be on its way to become one of the biggest banks in the continent, having already acquired Intercontinental and Diamond Banks in the past.

While Aigboje Imoukhuede, the Edo state born banking tsar was the managing director of the bank he shattered pundits after purchasing Intercontinental Bank Plc, a much bigger bank at the time. The deal that brought the Erastus Akingbola bank under the control of Access Bank is still a subject of debate among major stakeholders in the banking industry who have questioned whether, indeed the deal, consummated under the tenure of Lamido Sanusi as Central Bank of Nigeria, CBN Governor was made to pass through the needle eye of transparency and due diligence.

This is more so, analysts say, considering that Imoukhuede and Wigwe, Access Bank, two major personalities in the ‘merger’ were biggest debtors of Intercontinental Bank Plc, to the tune of over N16 billion. Their failure to pay back the loan, obtained through United Alliance Company, co-owned by the duo was cited by the CBN as one of the reasons for clamping down on the defunct Bank. The loan had a 36 months moratorium payment plan which the debtors failed to honour.

For instance, on August 18, 2009 the apex bank as part of efforts to rein in financial recklessness in the banking sector published an advertorial, categorizing Aig-Imokhuede’s United Alliance Company’s loan from Intercontinental Bank as a “non-performing” loan. The CBN noted that Wigwe and Aig-Imoukhuede’s debts were some of the largest loans that led to the collapse of the bank.

Now that the rumour mill has been agog of behind the scene moves by Access Bank to acquire Union Bank, many questions are being asked in the sector of what will likely be the fallouts should the parties agree to a deal.

The report that the two parties are considering a possible deal first emerged, two years ago with anxiety in the sector of grave implications for the industry, considering the massive job losses that normally follow such acquisition. Those in this school of thought may actually have a point, according to keen watchers in the sector, who cited the problems that followed Diamond Bank Plc acquisition in 2019.

Following the acquisition, Access bank systematically embarked on massive staff lay off, the most recent, being the sack, last year, of over 1500 employees, which the managing director of the bank said was necessary to keep the bank in business. The bank had earlier cut staff salary as part of in house restructuring.Wigwe laid the foundation for the mass sack of workers when he said “We probably don’t need as many security men as required, even to the fact that we are not going to have all our branches open between now and December. We don’t need all the tea girls. We don’t need all the cleaners. We don’t need all the tellers etcetera, etcetera,

“The second has to do with our professional cost. Now that is one that is very tricky and it is tricky because I do understand and appreciate that its gonna, you know, bring its own pain to staff. We basically have to make the adjustments the same way you sounded when we spoke 10 days ago with respect to basically cutting down cost.

“I will be the first to take the hit and I’m gonna take the largest pay cut, which would be as much as 40 percent. The rest we would have to cascade right through the institution. Everybody may have to make some adjustments of some sort”

Recall that not long after Access Bank acquired the Akingbola-led Intercontinental Bank Plc in 2011, it terminated the employment of about 1, 500 employees of the now defunct Bank, aside closing down some branches of the Bank nationwide.

But what constitutes grave concern to players in the industry, however, is how a relatively small bank like Access managed to subsume two big banks in less than six years with the third in the pipeline if everything falls in place with the acquisition of Union Bank.

Contrary to the banks position, sources have informed the magazine that its management is currently in talks with Atlas Mara aimed at finalizing a deal, which will bring Union Bank under Access management control. Atlas Mara is owned by Bob Diamond, who many say ran into financial storm last year, following the corona virus pandemic headwinds. The businessman, according to sources, is willing to sell his business interests in some blue chip companies to mitigate his financial problems. The firm has recently sold interests in Tanzanian and Rwanda to KCB Group Plc of Kenya, the same sources say.

Union Bank had earlier in 2019 denied having any acquisition talks with Access Bank. “Our attention has been drawn to a blog post on the aforementioned site (and circulating on social media) positing that Access Bank is in talks to acquire Union Bank. As the post itself states, the unfounded report is based on ‘mere rumours and speculation’. The Nigerian Stock Exchange, other regulatory agencies and members of the public are advised to disregard the publication in its entirety,” the bank said.

That is two years ago, as the bank has yet to issue another rebuttal since the acquisition ‘rumour’ gained momentum sometimes last month, with many keen watchers in the sector now saying that the talks between the two parties are already in ‘advance stage’ .

If the Union Bank deal sails successfully, analysts insist that Access Bank would become the only Nigerian bank to make three successful acquisitions in six years, an impossible feat for many top global banking brands.

Discover more from The Source

Subscribe to get the latest posts sent to your email.