By Fola James

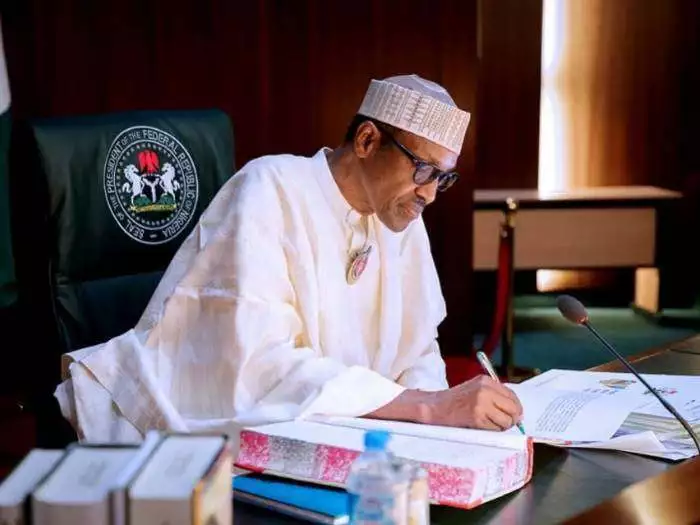

Less than 18 days into the new year, many Nigerians are already lamenting following the decision of the federal government to impose new taxes and levies, which may further compound the economic challenges facing them. Not withstanding the government’s argument of the urgent need to rally funds in the face of dwindling resources available to it, critics of the President Muhammadu Buhari administration said many more Nigeria will face hell next year due to unfriendly economic policies introduced by the regime.

Zainab Ahmed, the Minister of Finance and Budget disclosed government’s intention on Monday while address stakeholders during the public hearing on the 2021 Finance Bill organsied by the House of Representatives in Abuja, the nation’s capital.

Ahmed disclosed that the development is part of the federal government’s fiscal reform policy for next year, adding that the government will revisit some tax policies that have been abandoned.

Nigerians are however worried that imposing new taxes on the populace will further compound their economic woes, particularly at a time when the administration has hinted of plans to remove subsidy on basic social amenities such as petrol and electricity. For instance, the removal of petrol subsidy, many insist, will have ripple effects on the cost of food and transportation. But the government has said it will press ahead with its decision to abandon the fuel subsidy regime because it is no longer sustainable.

The mnister of Finance said penultimate week that the administration will try to cushion the effects of subsidy removal by giving N5000 monthly handouts to the most vulnerable Nigerians.

Ahmed said “the subsidies regime in the [oil] sector remains unsustainable and economically disingenuous. Ahead of the target date of mid-2022 for the complete elimination of fuel subsidies, we are working with our partners on measures to cushion the potential negative impact of the removal of the subsidies on the most vulnerable at the bottom 40% of the population.

“One of such measures would be to institute a monthly transport subsidy in the form of cash transfer of N5,000 to between 30 – 40 million deserving Nigerians.”

She has been rebuffed by many Nigerians who said such cash transfer may never get to those that need them, but end up in the private pockets of government officials, the same way like other cash transfer policies introduced by President Buhari since he came to power in 2015.

But speaking on the government’s plan to introduce new taxes and levies Mohammed, said the administration took the decision based on the fact that the economy is now recovering and as such many Nigerians are in the position to pay more taxes.

According to her, ”Our aspiration is to do a midterm review with a possibility of another Finance Bill in mid-year 2022 to bring in more amendments,” the minister said, noting that the federal government will ask the national assembly to review legislations on Stamp Duties and Capital Gains Tax.

“We prepared this draft bill along five reform areas, the first domestic revenue mobilisation, the second is tax administration and legislative drafting, third is International taxation, fourth is financial sector reforms and tax equity and fifth is improving public financial management reform.

“The provision in the draft bill is proposing to amend the Capital Gains Tax Act, Company Income Tax, FIRS Establishment Act, Personal Income Tax, Stamp Duties Act and Tertiary Education Act, Value Added Tax, Insurance Police Trust Fund and the Fiscal Responsibility Act.

“This is to amend the Police Trust Fund Act and the Nigerian Trust Fund Acts, the purpose is to empower the FIRS to collect the Nigerian trust fund levies on companies on behalf of the fund itself.

“Currently, because there is no such provision, the FIRS is unable to start collecting on behalf of the fund. Also, it is to streamline the tax and the levy collection from the Nigerian companies in line with Mr President’s administration ease of doing business policy. So we do not have NASENI going out to collect that tax, the FIRS will collect on their behalf during their collection process and it will be passed through to them.”

Meanwhile, the magazine understands that the plan to introduce new taxes and levies next year may be part of the ongoing plan to expand the nation’s tax net to accommodate working individuals and corporate bodies who have not been fulfilling their tax obligations to the government.

Discover more from The Source

Subscribe to get the latest posts sent to your email.